How’s the Market? Q3 2024 Review of Seattle Area Real Estate

While Q3’s summertime market slowed a bit from the frenetic spring pace of Q2 (we call this the “Summer Slump”), median home values are up across the region compared to this time last year. Most homes still sold at or above their listed prices in the first 10 days on market. However, buyers had more choice with higher inventory levels AND some room to negotiate on price for those homes that stayed on the market past the 10-day mark.

What does this mean for the rest of 2024? We typically see buyer activity decrease as we head into the holidays, and of course, it’s also election season. If you’ve been considering a purchase and are of the mindset that you don’t want to compete, THIS IS YOUR MARKET! For sellers the average days on market in Q3 was 20 for Seattle and 18 for the Eastside. Which means: if your price didn’t attract a buyer in the first two weeks, it’s probably time to re-evaluate. Interest rates are better than they’ve been since mid 2022. Quality inventory is being presented to the market. If you see a great house, be prepared to move quickly. Opportunity Knocks.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

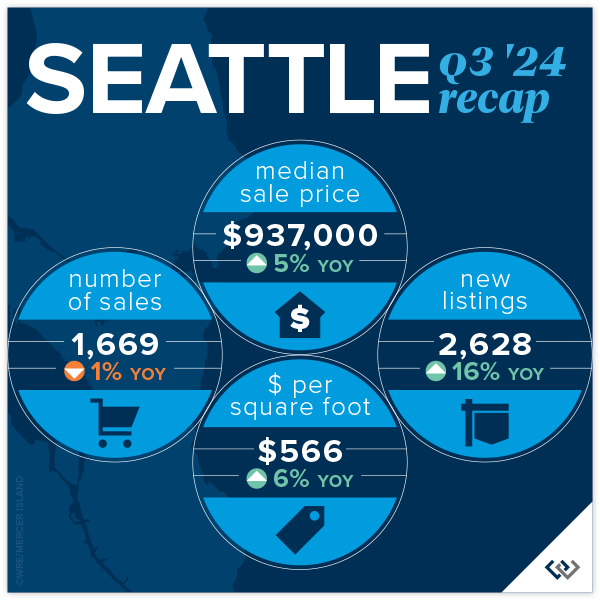

SEATTLE

Lots of good news in Seattle during our post-summer glow. Prices are up year over year by 5% to $937,000. While we’re still under the peak median of $1,000,000 set in Q2 of 2022 and $970,000 from last quarter, this is so typical for Q3. We’ve seen it every year from Q2 to Q3 going back to 2018 (except in 2020 largely because the real estate market shut down completely in Q2). Buyers had lots of choice, with more inventory to end the quarter than we’ve had since Q3 of 2022. Even with these buyer bright spots we still saw 56% of homes sell in the first 10 days and 34% over the asking price.

Average price per square foot and median price were in positive territory across the board this quarter in all neighborhoods. Richmond Beach/Shoreline and Madison Park/Capitol Hill both saw larger than typical gains in $/sq.ft. (11%) and median price (10%) respectively. North Seattle appeared to be the “hottest” market around with 64% of homes selling in the first 10 days. Again, really great numbers in Seattle given that Summer Slump was in full effect.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

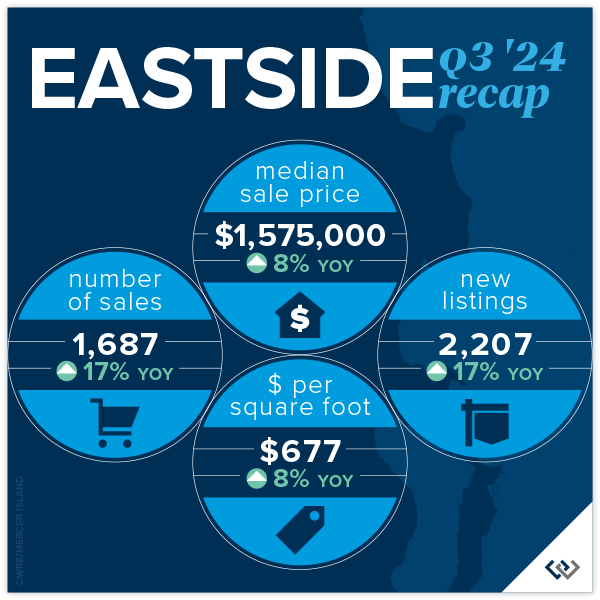

EASTSIDE

The Eastside continues to be the region’s crown jewel of real estate. Median prices are up again year over year by 8%. Most of us felt what we lovingly call the Summer Slump, and the numbers confirmed this. Prices (median) AND transactions were down 6% overall when compared against Q2 of 2024. That’s a $100,000 dip in median sales price if you missed the spring market. This is absolutely typical for the PNW and Metro King County. Seasonally our peak seasons are spring and post Labor Day/pre-holiday. This year that may be disrupted by election distractions. Time will tell if it’s a market lacking in consumer confidence or simply existential distraction.

The micro markets across the Eastside are fairly homogeneous. Among the 8 neighborhoods that we track, the median price swing was 3-11% but all in a positive direction. Total transaction volume is up 18% signaling that eventually life changes will trump a 2.5% interest rate. While homes were mostly selling in the first 10 days, multiple offers/paying over asking price were not the norm. In fact, the split between at, above, and below was relatively even.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

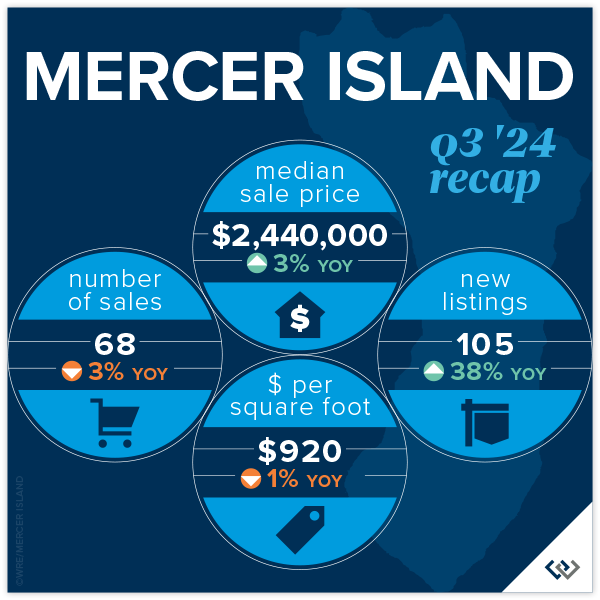

MERCER ISLAND

Fall has come for Mercer Island. The summer construction on Island Crest is done, school buses are out en force, and those filtered views that only come out in winter are starting to show. It’s time to look back fondly at the summer real estate market: prices are up YOY by 3% to $2,440,000 to end the quarter. This is likely more about trailing gains from a robust spring than it is about actual gains from Q3, given the indicators. A whopping 40% of homes sold under list price. It took 40% longer than 10 days to sell (not necessarily the same 40%) but only for about a 2% discount. This suggests that seller pricing and buyer motivation are evenly matched. There were 50 active listings at end of quarter, the most since Q2 of 2020 when real estate shut down completely.

Focusing on neighborhoods, The Lakes, Mercerwood, Mercerdale, and Mercer Island Estates saw 100% of homes sell in the first 10 days for an average of 102% of sales price. This goes to show that in any market, despite overall conditions, there will always be “hot homes.” Mid-Island had the most overall activity with 22 of the 68 sales across the Island. These occurred at $865/foot and 16 of the 22 homes sold in the first 10 days for at or above list price.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Once again, we’re rooting for the Seattle condo market as it proves to be the little engine that could! Chugging along toward modest price gains even when the rest of the market seems to be struggling a bit, Seattle condo prices have held steady for the last 6 quarters, with mostly positive change. Eastside condos hit a median price all-time high in Q2 at $709,000. We’re off of that a touch to $690,000 in Q3, to be expected after a beautiful summer. The Eastside ended the quarter with 29% more listings than this time last year and only 13% more sales. Mounting inventory tends to lead to price softening. Overall, nearly 50% of condos sold for at or above their list price!

When you compare the charts in the report, there is admittedly more positive news on the Eastside than in Seattle. Overall, we’re encouraged that despite many neighborhoods experiencing a drop in sales, average price per sq. ft. held flat and median price is up overall. On the Eastside it’s still great news all around for the market, especially in West Bellevue with 26% median sales price gains and total sales up 55%.

Friendly PSA: PLEASE remember that there is a ‘first rung’ of the property ladder. CONDOS create an affordable option to start building wealth at a younger age. It’s an important real estate product that has been overlooked. I am hopeful that enterprising young homeowners return to the condo market in droves this next real estate cycle.

Check out area-by-area details the full condo report.

WATERFRONT

While a bit slower compared to last quarter, waterfront sales remained strong in Q3 with 10 on the Eastside and 8 in Seattle. Lake Sammamish moderated in summer with just 5 sales compared to the crazy 15 we saw in spring, while Mercer Island stayed fairly steady with 4 (compared to 6 in spring). The highest sale was nearly $18 million for an immense Wendell Lovett designed 6,920 sq. ft. home on 125 feet of prime “gold coast” waterfront in Medina. The most modest sale was also on the Eastside—an original 1943 cottage on 53 feet of west-facing waterfront in Kennydale.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Kathryn Buchanan and Brandon Larson, Clarity Northwest Photography. Mercer Island cover photo courtesy of The Sirianni Group and Clarity Northwest Photography. Condo cover photo courtesy of Julie Wilson and Bobby Erdt, Clarity Northwest Photography. Waterfront cover photo courtesy of Anni Zilz and Andrew Webb, Clarity Northwest Photography.

Our Favorite Local Pumpkin Patches

Grab your boots, pack a thermos…it’s time to choose those perfect Halloween pumpkins! This year, why not explore a new town and make your pumpkin patch experience a true adventure? All of these farms are open every weekend in October, and some are open on weekdays too. Some even welcome your furry family members on a leash. Scroll down for the full scoop!

Eastside | North of Seattle | South of Seattle

Eastside

Fletcher Farm

Dog-friendly with a scavenger hunt, farm animal zoo, storybook trail, mini-golf, photo stations, and junior corn maze for the little ones. End of season Halloween Bash, too!

Open Sat & Sun, 11a-6p | Every weekend from 9/28-10/27

18712 SE May Valley Road | Issaquah

fletcherfarmevents@gmail.com

fletcherfarmissaquah.com

Jubilee Farm

Hay rides, food trucks, animals, barn store, & hot apple cider.

Open Sat & Sun, 10a-5p | Every weekend in October

229 W Snoqualmie River Rd NE | Carnation

(425) 222-4558

jubileefarm.org

Novelty Hill Farm

Dog-friendly! Corn maze, farm critters, trike track, hay mow, & picnic/fire pit rentals.

Open Fridays, 3-6p & Sat/Sun, 10a-5p | 9/27-10/27

26617 NE 124th Street | Duvall

(425) 788-2416

noveltyhillfarm.com

Oxbow Farm & Conservation Center

Live music, face painting, clue hunt, hay rides, mini pumpkin painting, living playground, kids’ farm tours, & apple slingshot.

Sat, 10/19 & Sun, 10/20 | 10a-4p

10819 Carnation-Duvall Rd. NE | Carnation

(425) 788-1134

oxbow.org/oxtober

Remlinger Farms

25 rides & attractions for children (including a train, carousel, & mini roller-coaster!), pony rides, apple cannon, cafe, & brewery with 20 choices on tap.

Open Sat & Sun, 10:30a-4:30p | Every weekend from 9/28-10/27

32610 NE 32nd Street | Carnation, WA

(425) 333-4135

remlingerfarms.com

Serres Farm

Mini train rides, corn maze and a dazzling variety of specialty pumpkins.

Open Sat & Sun, 9a-5p | Every weekend in October

20306 NE 50th St | Redmond, WA

(425) 868-3017

serresfarm.com/pumpkin-patch

Two Brothers Pumpkins at Game Haven Farm

Farm animals and an eerie number of well-attired scarecrows.

Open 9:30a-6p | Every weekend in October

7110 310th Avenue NE | Carnation, WA

(425) 333-4313

facebook.com/twobrotherspumpkins

North of Seattle

Bailey Vegetables

U-pick apples and kids play area with hay run, farm trikes & sandbox. Weekend kettle corn, cider and donuts, too!

Open Weekends, 10a-5:30p & Weekdays 12-5:30p | Late September-October

12698 Springhetti Rd | Snohomish

(360) 568-8826

baileyveg.com/pumpkin-patch

Bob’s Corn & Pumpkin Farm

12-acre corn maze, 2 kids’ mazes, play barn, hay rides, trike track, & apple cannon. Fire pit rentals for private groups, too!

Open Daily, 10a-7p (Last entry @5p) | 9/14-10/31

10917 Elliott Road | Snohomish

(360) 668-2506

bobscorn.com/Pumpkins

Carleton Farm

Corn maze, play area, jump pad, paintball shooting gallery, apple cannons, hay rides, & kids’ bucket train.

Open M-Sa, 10a-6p & Sun, 10a-5p | 9/28-10/31

630 Sunnyside Blvd SE | Lake Stevens, WA

(425) 343-4963

carletonfarm.com

Craven Farm

15-acre corn maze, kids maze, axe throwing, farm animals, mini golf, cow train, foosball, apple cannon, espresso, cider donuts, & scarecrow making. Fire pit rentals and special dog-friendly days, too!

Open Fri-Sun, 9:30a-6p | 9/14-9/30

Open Wed-Sun, 9:30a-6p | 10/1-10/27

13817 Short School Road | Snohomish

(360) 568-2601

cravenfarm.com/fall-festival

Fairbank Animal & Pumpkin Farm

Lots of baby animals, corn “maize maze,” tiny tot hay tunnel, toy duck races, photo boards, & veggie garden.

Open 10a-5p | Every weekend in October

15308 52nd Ave W | Edmonds

(425) 743-3694

fairbankfarm.com

Stocker Farms

30+ attractions including a mega slide, giant jumping pillow, tire mountain, epic play area, zip line, corn maze, pumpkin cannon, & more. The farm’s evil twin, Stalker Farms, comes out at night.

Open Daily 10a-6p (Last entry @5p) | September 21, 22, 28, & 30 | October 1-31

8705 Marsh Rd | Snohomish

(360) 568-7391

stockerfarms.com

Swans Trail Farms

Washington State corn maze, kids corn maze, petting farm, wagon rides, big slides, zip lines, u-pick apple orchard & live duck races.

Open Daily 10a-6p (Last entry @5p) | 9/14-10/31

7301 Rivershore Rd | Snohomish

(425) 330-3084

swanstrailfarms.com

South of Seattle

Carpinito Brothers Corn Maze & Pumpkin Patch

Rubber duck races, hay slides, corn pit, farm animals, hay maze, & corn maze.

Open Daily 9a-6p (or until dusk) | 9/27-10/31

Pumpkin Patch: 27508 W Valley Hwy N | Kent

Farm Fun Yard: 6720 S 277th St | Kent

(206) 786-4011

carpinito.com

Maris Farms

Racing pigs & ducks, mega slide, corn maze, jump pillow, animals, zip lines, rides, plus the creepy “Haunted Woods” complete with zombies and homicidal maniacs.

Open Fri-Sat 10a-10p, Sun 10a-7p | 9/28-10/27

25001 Sumner-Buckley Highway | Buckley

(253) 862-2848

marisfarms.com

Mosby Farms

Dog-friendly! Corn maze and fresh farm market.

Open Daily 10a-5:30p | 9/28-10/30

3104 SE Auburn-Black Diamond Rd | Auburn

(253) 939-7666

mosbyfarm.com/pumpkinpatch

Spooner Farms

Corn maze, pumpkin sling shot, speedway, farm animals, caramel apples, & roasted corn.

Open Daily 9a-6p | 9/28-10/31

9710 State Route 162 East | Puyallup

(253) 840-2059

spoonerberries.com

Thomasson Family Farm

Laser tag, corn maze, play barn, farm animals, slides, duck races, trike track, apple slingshot, and giant Jenga & Connect 4.

Open Daily 9:30a-5:30p | 9/28-10/30

38223 236th Avenue SE | Enumclaw

contactus@thomassonfamilyfarm.com

thomassonfarm.com

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate / Mercer Island.

Understanding Contingent Offers: A Seller’s Guide

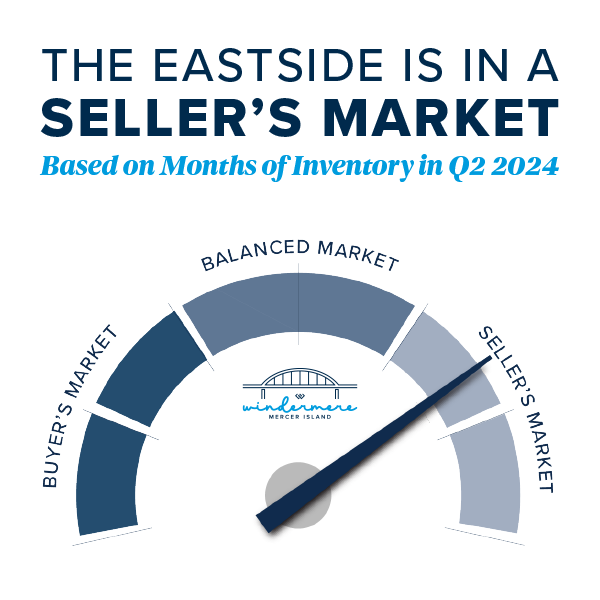

With the market shifting toward balance between buyers & sellers, “contingent” is a word sellers will be seeing more of. It’s important to understand the difference between a “contingent offer” and one with “contingencies.” Contingent offers allow the buyer time to sell their current home first before they complete the purchase. On the other hand, an offer with contingencies allows the buyer to cancel the contract with a full earnest money refund if the specified conditions aren’t met—often a satisfactory home inspection or the ability to obtain financing.

This may feel a bit like buyers want to have their cake and eat it too, but every homeowner can understand the desire to protect their investment before fully diving in. In a seller’s market, there are fewer homes available, which means buyers will do whatever they can to make their offer stand out. Because sellers have the leverage in these market conditions, you’ll often see buyers waiving their contingencies. Talk to your agent for more information about the local market conditions in which you’re selling.

Should I accept a contingent offer on my house?

Each home sale is different, and each seller has a unique story. What you’re looking for in an offer may be different from what someone else in your neighborhood is looking for when selling their home. It all depends on your circumstances, your timeline, your next steps, and your local market conditions. The extra stipulations in a contingent offer require the attention of an experienced real estate agent who can interpret what they mean for you as you head into negotiations.

How often do contingent offers fall through?

Contingent offers can fall through more often than non-contingent ones, but there’s no general rule of thumb. Whether a sellers and buyer are able to agree on the terms of a deal is a case-by-case situation. Different contingencies may carry different weight among certain sellers, and local market conditions usually play a significant role. For up-to-date information about your local market, visit our Market Reports page or Trends on our blog.

Pros and Cons of Contingent Offers for Sellers

Pros of Contingent Offers (allowing the buyer to sell their current home first):

- Accepting a contingent offer means you don’t have to take your home off the market quite yet, since the conditions of the deal haven’t been met. If the buyer backs out of the deal, you can sell without having to re-list.

- In certain cases, some buyers may be willing to pay extra to have their contingent offer met even if the home has been on the market for an extended period.

Pros of Offers with Contingencies (such as inspection, title, financing, etc.):

- You’ve got an offer! In a balanced market, one offer with contingencies is still better than no offers.

- It may protect you legally if you give the buyer the opportunity to do all of their due diligence while under contract. It’s harder for a buyer to come back and say something wasn’t disclosed when they had ample time and the contractual right to due diligence.

Cons:

- Home sales with any types of contingencies are usually slower than those without. It takes time to satisfy a buyer’s contingencies and additional time to communicate that they have been met.

- There’s a higher risk that the deal could fall through since the the buyer isn’t locked into the contract until of their contingencies have been satisfied.

It’s important to have an agent you can trust for guidance when facing contingent offers. Reach out to me any time—I’m never too busy to give advice or answer questions:

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

2024 Football & Hockey Schedules, Recipes, & Tips

Football is almost here and hockey is coming in hot behind it! Scroll down for printable schedules, tailgating hacks (including how to pack the perfect cooler!), and favorite gameday recipes. Fans of all ages will also love our printable football and hockey bingo sheets.

Need to brush up on your sports lingo? Check out Wikipedia’s handy football and hockey glossaries. You can say impressive things like, “Are they running a 3-4 defense?” and “It’s not icing unless the puck passes the goal line…”

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

How’s the Market? Q2 2024 Review of Seattle Area Real Estate

Median sales prices were up across the region in Q2 of 2024 compared to this time last year, with the Eastside posting the highest year-over-year appreciation. What should you know that the numbers don’t show? We’re back to a typical PNW seasonal market. Higher temps typically lead buyers to lose focus. There is still quality inventory hitting the market. If you don’t need to sell in order to buy, this summer is the perfect opportunity for you. There are some great deals out there, and this fall election season will be in full swing which will surely have an impact on all markets.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

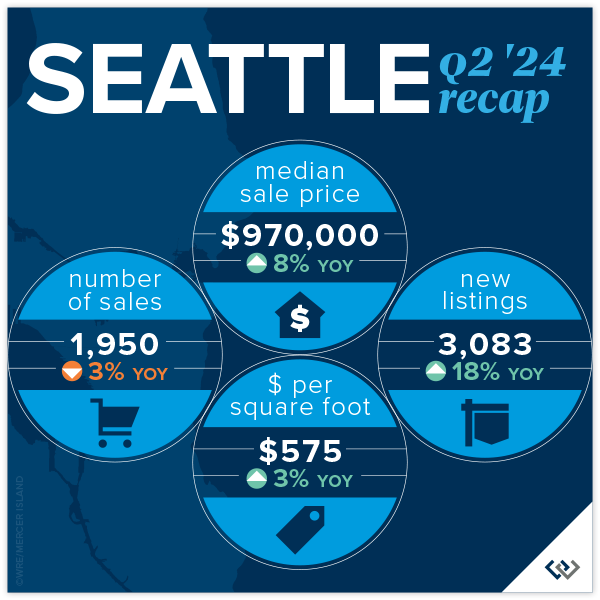

SEATTLE

The median home price in Seattle is up 8% year over year to $970,000! We are just 3% shy of the peak median price of $1,000,000 set in Q2 of 2022. With steady growth over the last couple of quarters one might assume that we’ll hit peak prices again shortly. This gain isn’t because of low inventory (up 18%) or a rapid growth in demand (sales are down 4%), it’s likely chalked up to interest rates under 7% AND buyers got tired of sitting on the sidelines. In all cases, the first half of this year has been a breath of fresh air.

Lake Forest Park saw the biggest drop in total number of sales at 34% BUT they also saw the highest jump in median price: up 19% to $1,015,000. Their neighbors to the West, Richmond Beach and Shoreline, saw the largest rise in sales with a 19% gain in total volume AND the only area to post a drop in median price. Down 1%. Madison Park/Capitol Hill is the only other area of the city to post double digit gains. All in all a robust spring quarter.

76% of homes sold for at or above list price and 71% of homes sold in the first 10 days on the market for an average of 105% of the list price. This tells us, if you find “The One,” don’t sleep on it, and be prepared to pay. Especially in the $800,000 to $1,500,000 price band.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

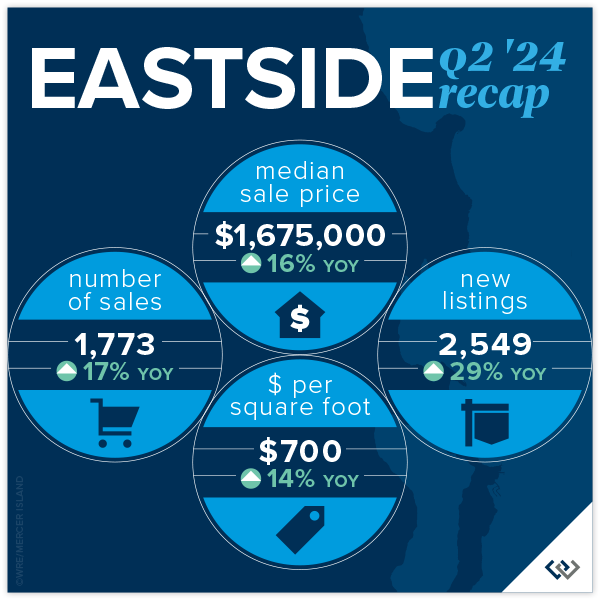

EASTSIDE

Everything’s coming up roses this spring on the Eastside. Home values have soared 16% year-over-year, with the median sale price reaching $1,675,000. This reflects a 4% gain from the peak in 2022. (Not all metro King County areas have reached peak prices again.) This impressive growth reflects a thriving market, with an average home selling for $700 per square foot, up 14% from last year. What’s even more fun? A whopping 78% of homes sold within the first 10 days of listing, showing just how bullish buyers are on the market.

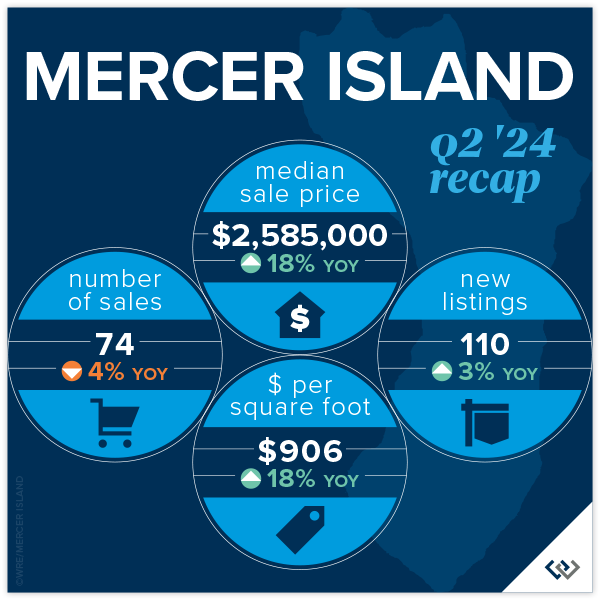

Neighborhoods across the Eastside are shining. Eastside South saw 251 homes sold, marking a 37% increase, with a median sale price of $1,799,000, up 20%. Meanwhile, West Bellevue’s median sale price jumped to $3,574,000, up 13%. Mercer Island continues to charm buyers, with homes selling for an average of $906 per square foot and a median price increase of 18%, reaching $2,585,000.

Overall, the Eastside market is buzzing with activity. With 1,773 homes sold (a 17% rise YoY), it’s clear that both buyers and sellers are seizing opportunities. The increase in new listings by 29% compared to last year adds to the market’s appeal. East Bellevue and Redmond also show significant growth, with median sale prices climbing by 7% and 27%, respectively. The Eastside has staying power post Covid, clearly.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

Home prices have seen a remarkable year-over-year increase of 18%, with the median sale price reaching $2,585,000. While this is a great sign for the health of the market, we’re still 5% below the 2022 peak. Affordability seems to be what is driving the market forward. Interest rates are down YoY. In relation to Q1 2024, prices are up a modest 2.5% which feels to us like: healthy sustainable growth.

Q2 2024 saw only a 3% rise in new listings compared to the same quarter last year, while there were 3 fewer homes sold in 2024 vs. 2023. Inventory and absorption remains relatively flat year over year. So it might be surprising that there is a robust demand for Mercer Island properties, with 66% of homes sold within the first 10 days of listing and that 18% rise in median price. Lower asking prices coupled with slight interest rate relief seem to be the explanation.

Taking a peek at the neighborhood snapshot reveals varying performance across different Mercer Island areas, yet the overall trend remains positive. For instance, the Northend saw 15 homes sold at an average of $810 per square foot, with 73% of these sales occurring at or above the listing price, and 60% sold within the first 10 days. On the higher end, East Seattle and The Lakes neighborhoods showcased exceptional performance, with all homes sold at or above the listing price and achieving 100% sales within the first 10 days. Overall, the average price per square foot for the island increased year-over-year, reaching $906.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

It’s good news only in the condo market! Seattle condos saw modest yet positive growth, with the median sale price rising 5% year-over-year to $636,000. The average price per square foot climbed to $649, a 7% increase, showing strong market demand. Condos in Ballard and Green Lake led the charge with a 31% increase in sales volume, while Downtown-Belltown, despite a 14% drop in sales, saw prices rise by 10%. Demand seems to be all over the board, but we’re still reporting the highest median sales price ever for Seattle condos!

On the Eastside, the market was buzzing with activity, in large part due to inventory being double what it was in Q2 of 2023. Redmond condos were the stars, with sales skyrocketing by 65% and the median sale price jumping 45% to $850,000. West Bellevue followed suit with a 38% increase in sales and a 33% hike in price per square foot, reaching $1,064. The overall Eastside market saw a 22% rise in sales and a 13% increase in the average price per square foot, now at $660.

It’s important to note that 62% of all condos selling at or above their list price across Seattle and the Eastside, showing a competitive market where buyers are eager to snap up properties quickly. With more new listings than last year there are plenty of opportunities for buyers and sellers alike. Whether you’re eyeing a trendy spot in Ballard or a luxurious condo in West Bellevue, the upbeat condo market promises exciting possibilities for everyone!

Friendly PSA: PLEASE remember that there is a ‘first rung’ of the property ladder. CONDOS create an affordable option to start building wealth at a younger age. It’s an important real estate product that has been overlooked. I am hopeful that enterprising young homeowners return to the condo market in droves this next real estate cycle.

Check out area-by-area details the full condo report.

WATERFRONT

Lake Sammamish led the pack in Q2 with a whopping 15 waterfront sales, while the Eastside was close behind with 12. Of Seattle’s 9 waterfront sales, all but 2 sold in less than 10 days. It was a similar story with Mercer Island’s 6 sales—all but 1 sold in less than 10 days and 4 sold above the asking price. Meydenbauer took the crown for largest waterfront sale, fetching $21.3 million for a truly stunning 1-acre estate with 164 feet of waterfront and a palatial 11,000+ sq. ft. home. The most modest waterfront sale was a Rainier Beach gem on 50 feet of waterfront that sold in just 8 days for $1,725,000.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

Main photo courtesy of Wing Walker Aerial Photography

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Codi Nelson and HD Estates Photography. Eastside cover photo courtesy of Donovan Realty Group and Tucker English Photography. Mercer Island cover photo courtesy of Yvonne Willard and Ryan Slimak, Clarity Northwest Photography. Condo cover photo courtesy of Luke Bartlett and Matthew Gallant, Clarity Northwest Photography. Waterfront cover photo courtesy of Kathryn Buchanan and Brandon Larson, Clarity Northwest Photography.

9 Fun Summer DIY Projects for Your Home

Sun’s out…fun’s out! Our glorious PNW summer is coming in hot with endless opportunities to enjoy the outdoors. Here are some fun and easy project ideas to help you make the most of it!

1. Backyard Movie Theater

Outdoor movies are a great way to enjoy your yard and entertain a crowd (and keep the mess outside, too!). Looking for affordable and easy? You can find portable, outdoor, Bluetooth enabled projectors for under $100; hang up a white sheet or inexpensive screen, grab your portable Bluetooth speaker, and BOOM…it’s movie time. Ready to take the leap and create something more lasting? Here is a great how-to for a wooden frame with pull-down screen + helpful tips for your AV setup.

2. Fire Pit

Who doesn’t love a good s’mores roast? Creating an attractive fire pit may be easier and cheaper than you imagined. One beautifully simple method we love is to create a ring of stacked bricks, stones or cinder blocks on top of a level pea gravel base, then place a store-bought metal fireplace bowl in the center (here is the full how-to). It’s remarkably fast and you don’t even need mortar! You can also go for a modern square look with cinder blocks, use a reclaimed metal receptacle, or find a full kit at the hardware store. Check out this list of 31 DIY fire pit ideas from the Spruce.

3. House Number Planter

Looking to add some instant curb appeal to your home? This elegant, inexpensive design may just be the “WOW!” you’re looking for. Choose modern house numbers for an updated look and then a little wood, some pretty plants, and a couple hours of work is all it takes to make your neighbors jealous.

Photo courtesy of ana-white.com

4. Giant Backyard Jenga

We LOVE this idea for summer BBQs, and it’s so easy! All you need are some 2×3 boards, a miter saw, and sandpaper (or a power sander, if you have one). Bada bing bada boom…jumbo Jenga to entertain kids and adults alike. Here are full instructions courtesy of Her Tool Belt, including the option to go fancy with colors and a DIY carrying crate that also doubles as a stand.

5. Decorative A/C Screen

If you’re lucky enough to have central A/C, you’re also unlucky enough to have an unsightly metal unit sitting in your yard. Fortunately, you can build a simple cover for less than $100 and in less than a day. Here is an easy plan from This Old House, designed with widely spaced slats for air flow and 1 foot of clearance (do your homework on your specific A/C unit before you dive in—you may need to size up). You can paint it to match your house color if you want to go incognito, or stain it for a stylish natural wood look.

Photo courtesy of tarynwhiteaker.com

6. Vertical Garden

Taking advantage of vertical space for planting means that even the smallest of patios can host a garden. It could be as simple as attaching pots to a trellis/rail or framed chicken wire, or something more elaborate like this beautiful living wall by This Old House. Vertical gardens can also double as privacy screens for your yard, porch or patio. Veggie enthusiasts can even build this easy vertical ladder planter with its own drip watering system. For the ultimate quick fix, felt pocket planters offer instant gratification—just attach to your fence or wall, add potting soil + slow release fertilizer + drought-tolerant plants, and water every 2 days. Using freestanding shelves for your container garden is another great option, especially for tenants who need something that is easily removable.

7. Leopold Bench

We love conservationist Aldo Leopold’s simple and iconic wooden bench plan, designed to be used both forward (with a backrest) or backward (where the backrest becomes an elbow rest for using binoculars). Here is a super easy DIY plan with cutting instructions from Construct101. Even amateurs can build this in less than a day, and all it takes are three boards, 6 carriage bolts, and some screws!

Photo courtesy of etsy.com

8. Hose Storage Planter

This ingenious project will boost your curb appeal in two ways, both by being an attractive planter AND by stowing away unsightly hoses in a clever hidden storage compartment. There are a few different styles and plans out there. We like this version from DIY Candy with a hinged front that allows you to access the hose without having to lift up the heavy planter. It can be crafted from a pallet or any other reclaimed wood. The Kim Six Fix also has this version made with cedar fence boards instead.

Photo courtesy of diycandy.com

9. Rain Garden

Did the April showers leave your yard (or basement) a little soggy? Sump pump working overtime? A rain garden is a beautiful way to channel water away from your house while also helping the environment by keeping chemical runoff out of rivers and lakes. The concept is pretty simple: create a below-grade garden bed planted with deep-rooted species that help capture and drain water rapidly into the soil. If you’re serious about improving drainage, you’ll also want either a stone channel or buried PVC pipe to help guide water from your downspout into the garden. Collect some friends to help with the digging! Here are full instructions from the Family Handyman.

If you’re considering selling your home, some of these projects—like planters and vertical garden privacy screens—can help maximize your curb appeal. A rain garden might also be a beautiful solution for drainage issues that need to be resolved before your house can go on the market. Looking for more ideas or advice? Reach out to me any time…I’m never too busy to help!

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Why Buyer Representation Matters So Much to Sellers

In today’s rapidly changing real estate landscape, understanding the critical role of buyer representation has never been more essential for home sellers. With the pending NAR settlement on the horizon, many sellers may not fully grasp the significant impact these changes will have on their transactions. The urgency to adapt is real, and overlooking the necessity of paying a buyer agent compensation could expose sellers to unforeseen risks.

Currently, home buyers are not allowed to roll their buyer agent compensation into their loan. This means they must bring cash to the table to pay their agent (if the seller is not offering buyer agent compensation).

Unrepresented buyers should be considered more than a minor hiccup—it can lead to a cascade of complications that jeopardize the entire deal. To safeguard your investment and ensure a smooth transaction, it’s crucial to recognize the invaluable support a buyer’s agent provides.

What value does a seller receive if the buyer has professional representation? Let us list the ways:

Lender Connections: Buyer agents connect their buyers with well-vetted (and typically local) lender partners who have proven time and again that they can close a transaction, and on time.

Documentation Management: Buyer agents ensure that buyers have delivered all necessary documentation to the lender to ensure full underwriting.

Market Analysis: Buyer agents provide comparable market analysis reports (CMAs) to help buyers understand the market value of the home and support a reasonable offer price.

Contract Guidance: Buyer agents guide their clients through the purchase and sale agreement, ensuring that they understand the terms and conditions and their ability to fulfill their commitments.

Contingency Explanation: Buyer agents explain all contingencies to buyers, ensuring they understand the risks and rewards, especially when waiving contingencies.

Earnest Money Handling: Buyer agents ensure that earnest money funds are delivered to escrow on time.

Transaction Deadlines: Buyer agents ensure that their client and their lender observe and adhere to all deadlines to keep the transaction flowing smoothly and closing on time.

Inspection Access: Buyer agents provide access to home inspectors and help their buyers understand the reports. This is critical as most MLS associations require an agent to be present whenever a door is opened. If the buyer doesn’t have representation, the listing agent must give access, exposing them to inspection findings and forcing them to disclose on behalf of the seller.

Appraisal Assistance: Buyer agents give access to appraisers and typically provide reports of comparable properties to support the purchase price, ensuring the property appraises at value.

Negotiation Support: If the appraisal report comes in less than the purchase price, the buyer agent will help negotiate and collaborate with the listing agent to ensure a mutual agreement is reached by all parties.

Transaction Coordination: Most importantly, the buyer agent helps keep their client and all parties on track to ensure closing, and crucially, on time.

The value a buyer agent brings to the transaction is indispensable. Their expertise not only facilitates a smoother process but also protects all parties involved from potential pitfalls. By ensuring the buyer has professional representation, sellers can avoid significant risks and secure a successful transaction. In the evolving real estate market, investing in buyer agent compensation is a wise decision that benefits everyone involved.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere blog on 5/29/24 & Inman News on 5/21/24.

What You Need to Know about the Washington State Seller Property Disclosure – Form 17

Washington State requires sellers of residential real property to thoroughly disclose material facts on a form called the Residential Real Property Disclosure Statement (often referred to as Form 17). Unless the buyer has expressly waived their rights, the seller must deliver this completed disclosure within 5 days after mutual acceptance. The buyer then has a window of time to walk away with their earnest money at their discretion.

While sellers have always been required to disclose material facts, the Form 17 has been required by law (RCW 64.06.020) since January 1, 1995. It has undergone ten revisions since its inception, the last of which went into effect in 2021. In addition to the residential disclosure, the state added an unimproved property (land) disclosure in 2007 (RCW 64.06.015) and a commercial property disclosure in 2012 (RCW 64.06.013). The current form is 6 pages long and includes most of the typical property issues requiring disclosure with a catchall question for anything left out.

Is every seller required to complete this form? Are there exemptions?

The statute allows very limited exceptions RCW (64.06.010) to completing the disclosure statement. They include transfers…

- by foreclosure or deed-in-lieu of foreclosure

- that are gifts to a parent, spouse, domestic partner, or child

- related to marital dissolution or dissolution of a state registered domestic partnership

- to buyers who had a prior ownership interest in the property in the last two years

- of an interest that is less than fee simple

- made by the personal representative of the estate or by a trustee in bankruptcy

- in which the buyer has expressly waived the receipt of the seller disclosure statement

However, if the answer to any of the questions in the section entitled “Environmental” would be “yes,” the buyer may not waive the receipt of the “Environmental” section of the seller disclosure statement.

What happens after delivery of the disclosure statement?

The buyer has three business days from receipt of the disclosure statement to cancel the agreement for the purchase of the property (unless they waived their rights to do so in writing).

This right to rescind is statutory, and the decision to revoke the offer may be made by the buyer at the buyer’s sole discretion. If the buyer elects to rescind the agreement, the buyer must deliver written notice of rescission to the seller within the three-business-day period.

Upon delivery of the written rescission notice the buyer is entitled to immediate return of all earnest money deposits and the agreement for purchase becomes void.

If the buyer does not deliver notice the disclosure statement is deemed approved and accepted by the buyer. The full provisions of this right are found in RCW (64.06.030).

What happens if the seller doesn’t deliver a completed disclosure?

If the seller fails or refuses to provide a disclosure statement to buyer within 5 days, the prospective buyer’s right of rescission extends until the earlier of three business days after receipt of the disclosure statement or the date the transfer has closed (unless the buyer has otherwise waived the right of rescission in writing). After closing, per RCW 64.06.040 (3) the seller’s obligation to deliver the disclosure statement and the buyer’s rights and remedies related to it terminate.

Some sellers are more forthcoming than others…

When sellers claim there are no issues to explain, you should be wary…very wary. In my years of practice, I have yet to see a perfect house. Whether a 10-million-dollar estate, a newly constructed home, or a $300,000 starter home, every house has a story and every buyer has a right to know about it so they can knowledgeably complete their due diligence.

Making full disclosure actually benefits the seller, too. By disclosing a condition, the seller shifts the burden of investigation to the buyer under Washington law. By remaining silent, a seller risks the appearance of concealment and a lawsuit. Think of it this way: disclose an issue and if the buyer accepts it you move forward with no worries since they are barred from seeking compensation later; fail to disclose it and you could be looking over your shoulder for years.

I like to see issues disclosed on a disclosure statement. It makes me feel like the seller has been honest and transparent. When I see a “perfect” disclosure, I know the seller is either in total denial or has decided not to disclosure the little (or big) issues they know about. Most buyers expect far more disclosure from the seller than the law requires. While sellers don’t have a duty to inspect their home or look for defects, they do have a duty to disclose defects that affect the value, physical condition, or title to the property. Sellers should consider disclosure to be a form of insurance.

Instead of minimizing disclosures, a prudent seller will try to consider the property from the perspective of a buyer and then disclose what a buyer would want to know. Many of the conditions that lead to lawsuits would have been acceptable to the buyer if they had been disclosed in advance. Other conditions simply are not important enough to the buyer to fully investigate before purchasing a property. To maximize the benefit of disclosure law, sellers may want to make full disclosure of the property and neighborhood even if they have no legal duty to do so. It is usually better to be over-insured than not insured at all.

Buyers have duties, too…

In addition to a thorough inspection, investigating issues raised in the seller disclosure statement is one of the most important parts of due diligence in a real estate transaction. Buyers have a duty of thoroughness and inspection that should not be taken lightly.

The buyer should evaluate each disclosed item, and (especially) those items not disclosed, but easily discovered during a walk-through and inspection. If there are many items identified and not disclosed, a buyer should be concerned about other unseen issues that might also not be disclosed. A savvy buyer will investigate a home with limited disclosure more thoroughly and/or make the decision not to purchase form a seller who is seemingly not transparent with the truth.

It is also important to note that sellers typically have no duty to disclose neighborhood conditions or past events at the property, even though these may be issues of concern to the buyer. For instance, sellers usually have no legal duty to disclose the following conditions either at the property or in the neighborhood:

- Death, murders, suicides, rapes or other crimes

- Ongoing criminal or gang activity in the neighborhood

- Registered sex offenders in the neighborhood (RCW 64.06.021)

- Future development in the area

- Political or religious activities in the area

If these or similar matters are of concern, buyer should conduct their due diligence prior to submitting an offer or include an inspection and “Neighborhood Review” contingency in the offer to allow them time to complete it as part of their purchase agreement.

What is the seller’s responsibility after delivery of disclosure statement?

The disclosure statute (64.06.040) states that if after delivering a completed disclosure statement, the seller learns from a source other than the buyer or others acting on the buyer’s behalf such as an inspector of additional information or an adverse change which makes any of the disclosures made inaccurate, the seller shall amend the real property transfer disclosure statement, and deliver the amendment to the buyer. The buyer then has the right to rescind the purchase agreement within three business days after receiving the amended disclosure statement.

No amendment is required if the seller takes whatever corrective action is necessary so that the accuracy of the disclosure is restored, or the adverse change is corrected, at least three business days prior to the closing date.

The seller disclosure statement is not a warranty

RCW 64.06.050 says the seller shall not be liable for any error, inaccuracy, or omission in the disclosure statement if the seller had no actual knowledge of the error, inaccuracy, or omission. This includes disclosures based on information provided by public agencies, or by other persons providing information within the scope of their professional license or expertise, including, but not limited to, a report or opinion delivered by a land surveyor, title company, title insurance company, structural inspector, pest inspector, licensed engineer, or contractor. This applies to the seller’s real estate broker as well.

This should give a conscientious seller the assurance that the statute provides for property disclosure only and is not a warranty of current or ongoing condition. Provided a seller discloses everything they know, or that a reasonable seller should have known, about their property, a seller should feel good in knowing they are not held liable for its condition.

Here are a few great online resources to add to your knowledge base:

Current local Form 17 Real Property Transfer Disclosure Statement: https://windermeremi.com/files/2024/05/17_SellerDiscl.pdf

The complete text of the Washington State Real Property Transfer Act: https://app.leg.wa.gov/RCW/default.aspx?cite=64.06&full=true

NOLO Article: https://www.nolo.com/legal-encyclopedia/residential-home-sellers-washington-what-the-law-requires-you-disclose.html

Of course, nothing tops having an experienced pro to guide you through the process. We’ve seen hundreds upon hundreds of homes and can help you identify the solid finds from the duds with gorgeous looking veneer.

Choosing the right broker can save you thousands on your home purchase. Whether through local market knowledge and pricing analysis allowing you to make a smarter offer, recommendations and resources to thoroughly conduct your due diligence and avoid costly mistakes, or savvy contract negotiation to help you get the terms you need, having a Windermere broker on your side is an advantage you can’t afford to sacrifice.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2020-2024, Windermere Real Estate/Mercer Island. Originally written by Julie Barrows.

2024 Seattle & Eastside Farmers Markets: Locations, Times & More

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies).

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

Tuesdays, 3pm – 7pm (June 4 – September 24, 2024)

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 1 – Oct 9, 2024

Special Market Days on Saturday, 11/9/24 & 12/14/24, 10am-2pm

37th Ave S & S Edmunds St | Seattle

seattlefarmersmarkets.org/ccfm

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 13 – Oct 3, 2024

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 12 – Oct 20, 2024

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 17 – Oct 25, 2024

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 1 – Oct 12, 2024

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

6532 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm (farm tables close at 4pm) | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | May 30 – Oct 10, 2024

Spring Preview Market on May 11, 2024, 10am-3pm

Harvest Markets on Oct. 26, Nov. 23 & Dec. 14, 2024, 10am-3pm

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Shoreline

Now located at the BikeLink Park & Ride (corner of 192nd & Aurora, across from Sky Nursery), this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods.

Saturdays, 10am – 2pm | June 1 – Oct 5, 2024 + Harvest Markets on Oct. 26 & Dec. 14

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

University District

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 29 – Sept 25, 2024

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

West Seattle

A South Seattle weekend destination, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with handmade soaps, candles, dog treats, herbal wellness products, and more. Don’t miss the Salvadorean pupusas, Russian-style crepes, and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 4 – Sept 24, 2024

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Power of Produce (POP) club empowers kids to know where their food comes from and make healthy eating choices.

May 23 – Sept 26, 2024: Thursdays, 3pm – 7pm

Oct 3-24: Thursdays, 3pm-6pm

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2024

Tolt-MacDonald Park, 31020 NE 40th St | Carnation

carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursdays, 3pm – 7pm | May 2 – October 10, 2024

Taylor Landing at 16201 Main St NE | Duvall

Parking Map

duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 4 – Sept 28, 2024

Holiday Markets on Oct 26, Nov 23, & Dec 14, 2024

Pickering Barn, 1730 10th Ave NW | Issaquah

Market Map

www.issaquahwa.gov/778/Farmers-Market

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June 5 – September 25, 2024

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Mercer Island

Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 2pm | June 2 – Sept 29, 2024

Harvest Market on Nov 24, 2024

Mercerdale Park, 7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

June 6 – August 22, 2024: Thursdays, 4pm – 8pm (Closed July 4)

August 29 – September 12, 2024: Thursdays, 3:30pm – 7:30pm

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 11 – Oct 26, 2024

9900 Willows Rd NE | Redmond

www.redmondsaturdaymarket.org

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton at Piazza Park. Food trucks, live music, and kids’ activities such as the “Healthy Kids Corner” make this a fun spot to liven up your Tuesday.

Tuesdays, 3pm – 7pm | June – Sept, 2024

Piazza Park, 233 Burnett Ave. S | Renton

www.rentonfarmersmarket.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May 15 – Sept 25, 2024 (Closed July 3)

Sammamish Commons, 801 228 Ave SE | Sammamish

www.sammamishfarmersmarket.org

Woodinville

Note the new hours for 2024! Come check out downtown Woodinville’s Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse. Check out the calendar for live entertainment, music, demos, and other activities.

Saturdays, 10am – 2pm | May 4 – Sept 28, 2024

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link