How to Price Your Home for Sale

The right listing price is absolutely critical to a successful home sale. Price too high and you will miss your shot to generate interest with a sense of urgency for buyers—often, overpriced listings languish on the market and end up selling for less than they would have if they’d been priced more competitively from the get-go. Price too low, however, and you risk leaving money on the table if your home doesn’t attract multiple offers. So how do you price it right?

As agents, we track market conditions daily to understand where the “Goldilocks zone” lies for different neighborhoods and price points based on buyer demand and competing properties. Your best bet is to work closely with your agent on an effective pricing strategy before listing your home…BUT in the meantime, here’s some info to help you better understand what goes into this process.

- Understanding the Value of Your Home: Market Value vs. Assessed Value and More

- The Difference Between a Comparative Market Analysis and an Appraisal

What’s your home worth?

While nothing can replace an in-person evaluation by a real estate agent or appraiser, automated valuation models (AVMs) can be a helpful first step in determining what your home is worth. AVMs assess your home by comparing its information with the listings in your area. An algorithm can’t possibly know about the unique characteristics of your home or its neighborhood…but it can give you a rough ballpark idea of your home’s value and how it’s changing over time. Curious? Try my Home Worth Estimator here:

What factors influence home prices?

Understanding what factors influence home prices will give you a deeper knowledge of the market, give clarity to the selling process, and help you work with your agent to accurately price your home.

Comparable Home Sales

Comparable home sales—or “comps”—have a major impact on the price of your home. Comps refer to the comparable homes in your area, both pending and sold, within the last six months. I can provide you with a Comparative Market Analysis (CMA) to better determine the price of your home. CMAs factor in aspects such as square footage, age, and lot size compared to other homes in your area, to determine how your home should be priced among the competition. Reach out if you’d like to request one.

Your Home’s Location

Location, location, location. It plays one of the most significant roles in your home’s asking price. Market conditions in your area, whether you reside in a metropolitan, suburban, or rural location, and the home’s proximity to amenities, schools, and entertainment all contribute to the price.

Your Home’s Condition

If you have recently invested in upgrades or other remodeling projects for your home, they could increase your asking price. However, the price increase potential depends on the kind of renovation, its ROI, and how valuable it is to buyers in your area. If the home needs repair, it will likely generate less interest from buyers than better maintained homes at your price point. Any outstanding repairs or projects looming overhead will make the home less attractive to buyers and could lead to a low appraisal.

Seasonality

Any factors that impact market supply and demand are worth taking into consideration when preparing to price your home, and seasonality is one that cannot be overlooked. Typically, market activity slows in the winter and picks up during the spring and summer months. For more in-depth info, check out these articles on The Best Time to Buy or Sell a Home and Timing the Market.

Market Conditions

Finding a competitive listing price will be depend on local conditions, such as whether it’s a buyer’s or seller’s market. Some sellers think that pricing their home over market value means they’ll sell for more money, but the opposite can often be true. Overpricing your home presents various dangers such as sitting on the market too long, which can result in selling for well below what it’s worth.

Periodic Price Adjustments

Pricing a home isn’t a set-it-and-forget-it proposal. As with any strategy, you need to be prepared to adapt to fast-changing market conditions, new competition, a lack of offers, and other outside factors.

These are the basic tenets for understanding what goes into the price of a home. When you’re ready, I can interpret and expand on this information, perform a CMA for your home, and guide you throughout your selling journey.

Adapted from an article originally appeared on the Windermere blog October 5, 2022.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

A Consumer’s Guide to Homeowners Insurance

If you’re a homeowner or looking to buy a home, insuring your property is critical to protecting your investment—and if you’re getting a mortgage, it’s a must. It can be daunting trying to navigate the many options available to you. What does your policy cover…and what isn’t covered? What does the insurance company provide if your property is damaged or destroyed? Recently, the National Association of REALTORS® released this helpful guide on understanding the ins and outs of homeowners insurance. Here is a quick rundown of what you need to know…

How does property insurance work?

For certain unexpected events that cause a loss to your home or property, homeowner’s insurance can cover the cost to repair/rebuild the property and other structures like fences or garages. Most policies also cover personal belongings within the home, legal/medical fees for accidents occurring on the property, and temporary housing if a covered event (like a house fire) makes your home uninhabitable.

What losses are covered?

Your insurance policy will list the specific “perils” that are covered. The most common type of policy covers both the structure and personal assets for losses from house fires, storms, freezing, theft, vandalism, and sudden plumbing bursts—this is known as a HO-3 or “Special Form” policy. Most policies don’t cover earthquakes or natural floods (although you can get additional policies for those perils).

Is insurance required?

There are no laws requiring you to maintain homeowners insurance. However, most lenders require it for the duration of your mortgage. Required or not, it’s generally a good idea to protect your assets (especially if you have a lot of equity in your home).

What is the cost, and how is it paid?

As with many costs, insurance premiums are on the rise throughout the country (here’s how much, where, and why). Your individual policy’s cost will be based on your home’s age, size, condition, location, and other factors like whether you have a security system or have added on additional coverage. You may have the option to pay the premium annually or break it into smaller payments. If you have a mortgage, the lender usually collects a monthly “escrow” payment that they keep in an account to pay the insurance premiums and property taxes from on your behalf.

What happens in the event of a loss?

Most insurers will cover “replacement cost”—the amount needed to buy a new, comparable version of what you lost up to a dollar limit specified in the policy. It’s important to understand that replacement cost is not the same as market value; you’ll be compensated for the actual cost to repair/rebuild/replace your home regardless of what you paid for it or what you could sell it for. Typically the insurer will reimburse you to have your home repaired or replaced with comparable quality if it’s insured to at least 80% of it’s replacement cost, less any deductible that your policy has.

Alternatively, “actual cash value” is the current value of an item that depreciates over time or with use (often used for replacing personal or under-insured property). For example, if you paid $2,000 for your new couch but now it’s only worth $1,000 due to normal wear and tear, your insurer will only pay $1,000 less the deductible. You may choose to upgrade your personal property coverage to replacement cost instead for an extra fee.

For extra peace of mind, you can also purchase an extended replacement cost policy that provides extra coverage up to a set percentage above the policy limit. This can protect you if your home costs more than anticipated to rebuild.

Are the premiums tax deductible?

The short answer is no, unless you run a business from your home or it’s a rental property. However, you may be able to claim a casualty loss deduction if you suffered a loss due to a federally declared disaster (but check in with your tax pro for advice specific to your situation).

Because laws vary from state to state, it’s important to do your homework if you’re purchasing a home in an unfamiliar area. You can either connect with me or your attorney for advice.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

2025 Seattle & Eastside Farmers Markets

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies).

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- First Hill

- Fremont

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- South Lake Union – Farmers Market

- South Lake Union – Saturday Market

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

Tuesdays, 3pm – 7pm (June 3 – September 30, 2025)

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 7 – Oct 15, 2025

37th Ave S & S Edmunds St | Seattle

seattlefarmersmarkets.org/ccfm

First Hill

A Pike Place Satellite Market, this small “express market” offers locally sourced veggies, fruits, flowers, honey, jam, and organic meats from the region’s finest farms.

Fridays, 10am – 2pm | June 20 – Sept 26, 2025

9th Avenue & University Street | Seattle

pikeplacemarket.org/market-programs-events/farmers-markets

Fremont

With a newly expanded Promenade encompassing two blocks along the Fremont Canal, you can find just about everything at this “hyper market”—an eclectic mix of a farmer’s market, flea market and artists’ alley. The food is pretty epic, too!

Sundays, 10am – 4pm | Year-Round

3401 Evanston Ave N | Seattle

fremontmarket.com

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 12 – Oct 2, 2025

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 11 – Oct 19, 2025

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 16 – Oct 31, 2025

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 7 – Oct 11, 2025

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 6 – Sept 26, 2025

6532 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm (farm tables close at 4pm) | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | May 29 – Oct 9, 2025

Spring Preview Market on May 10, 2025, 10am-3pm

Harvest Markets on Oct. 25 & Nov. 22, 10am-3pm

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Shoreline

Now located at the BikeLink Park & Ride (corner of 192nd & Aurora, across from Sky Nursery), this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods.

Saturdays, 10am – 2pm | June 7 – Oct 25, 2025

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

South Lake Union – Farmers Market

Affiliated with Pike Place Market, this small satellite market offers locally sourced veggies, fruits, flowers, honey, jam, and organic meats from the region’s finest farms.

Thursdays, 10am – 2pm | June 26 – Sept 25, 2025

426 Terry Avenue N | Seattle

pikeplacemarket.org/market-programs-events/farmers-markets/

South Lake Union – Saturday Market

Note the new location for 2025 on 6th Ave, next to The Spheres. More of a makers market along with vintage boutiques and food trucks…you won’t find traditional produce booths, but you will find brunch and plenty of retail therapy.

Saturdays, 11am – 4pm | June 7 – Sept 27, 2025

6th Ave & Lenora St | Seattle

slumarket.com

University District

Come visit Seattle’s largest and oldest farm/food only market, recognized as one of the best farmers markets in the U.S.! With over 80 booths and hard-to-find ingredients, it’s a chef’s delight.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 28 – Sept 24, 2025

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

West Seattle

A weekend destination for families across the area, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with hand crafted bird houses, candles, dog accessories, herbal wellness products, and more. Don’t miss the tacos, Nepalese street food, and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 3 – Sept 30, 2025

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Power of Produce (POP) club empowers kids to know where their food comes from and make healthy eating choices.

Thursdays, 3pm – 7:30pm | May 22 – Oct 2, 2025

(Closes at 7pm after Labor Day)

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2025

Tolt-MacDonald Park, 31020 NE 40th St | Carnation

carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursdays, 3pm – 7pm | May 1 – October 9, 2025

(Closes at Sunset in October)

Taylor Landing at 16201 Main St NE | Duvall

Parking Map

duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 10 – Sept 27, 2025

Pickering Barn, 1730 10th Ave NW | Issaquah

Market Map

www.issaquahwa.gov/778/Farmers-Market

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June 4 – September 24, 2025

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June 6 – Sept 26, 2025

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Mercer Island

Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 2pm | June 1 – Sept 28, 2025

Farmers Only Pop-Up Market: Oct 12, 2025

Harvest Market: Nov 23, 2025

Mercerdale Park, 7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Kids can participate in the Power of Produce (PoP) Club. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

June 5 – August 21, 2025: Thursdays, 4pm – 8pm (Closed 6/19 for Juneteenth)

August 28 – September 11, 2025: Thursdays, 3:30pm – 7:30pm

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 3 – Oct 25, 2025 (Closed May 10th)

9900 Willows Rd NE | Redmond

www.redmondsaturdaymarket.org

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton. Food trucks, live music, and kids’ activities make this a fun spot to liven up your Tuesday. Note: for 2025, the market has moved a couple of blocks to Williams Ave S while Piazza Park is being refurbished.

Tuesdays, 3pm – 7pm | June 3 – Sept 30, 2025

Willliams Ave S (Between S 2nd & S 3rd Streets) | Renton

www.rentonfarmersmarket.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May 7 – Sept 17, 2025

Sammamish Commons, 801 228 Ave SE | Sammamish

Parking: Mary, Queen of Peace Catholic Church, 1121 228th Ave SE

www.sammamishfarmersmarket.org

Woodinville

Come check out downtown Woodinville’s Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse.

Saturdays, 10am – 2pm | May 3 – Sept 27, 2025

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

How’s the Market? Q1 2025 Review of Seattle Area Real Estate

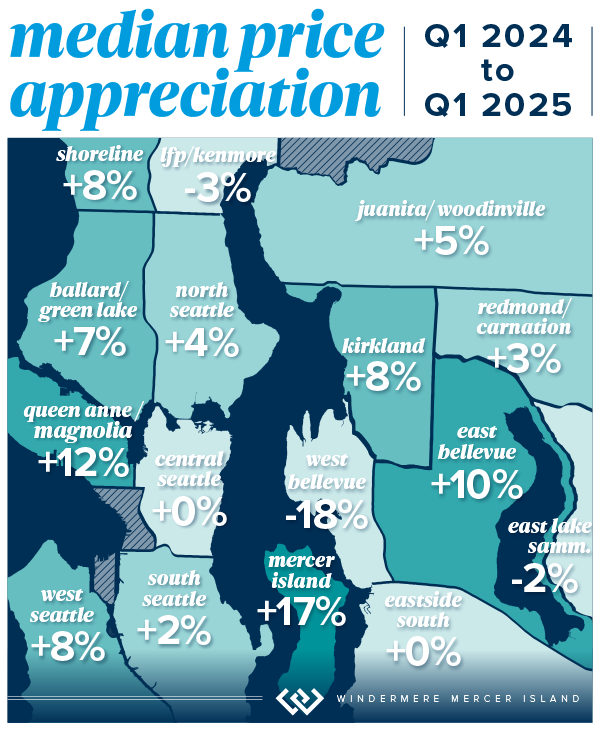

Q1 started the year off strong for Seattle-area real estate with the majority of homes selling in the first 10 days on the market and for at or above their listed prices. Median sales prices were also up compared to Q1 of last year. Buyers enjoyed more choice with new listings outpacing sales, steadily increasing our supply of available homes for sale.

What the numbers don’t show yet is that the spring market sprang early, in January and February; now that prime inventory is hitting the market, demand appears to be waning. Our advice to Home Shoppers: don’t take any chances. Just because the last new listing didn’t sell in a competitive situation, doesn’t mean the next one won’t. If you love the home, act with confidence. Our advice to Home Sellers: don’t take any chances. Prep well, price appropriately, and take that first buyer seriously. It’s unpredictable out there.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

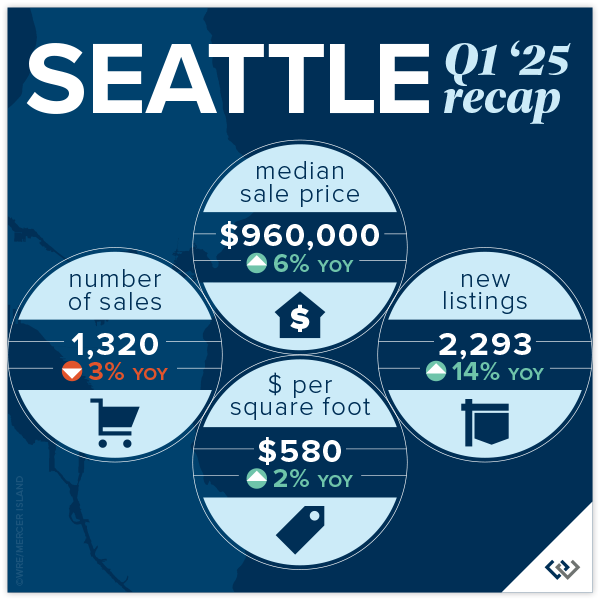

SEATTLE

The Seattle real estate market continues to show encouraging signs of strength and stability as we step into 2025. Median home prices rose 6% year-over-year to $960,000, building on the 9% increase we saw in Q1 2024 and rebounding from $830,000 in Q1 2023. That’s a remarkable $130,000 gain in just two years. Inventory is also trending in the right direction, with 2,293 new listings this quarter—up 14% from Q1 2024 and significantly higher than the 1,958 new listings in Q1 2023. It appears that need is outweighing the pull of a sub 3% interest rate when considering whether or not to make a move.

Momentum is visible across several neighborhoods. West Seattle, for instance, saw 75% of homes sell at or above list price (up from 71% last year and 70% the year before), while North Seattle maintained its reputation for competitive sales—70% sold at or above list and 66% sold in the first 10 days. Madison Park & Capitol Hill remained a strong performer with an impressive median price of $1,100,000; holding steady year-over-year after a 10% jump last year.

Citywide, 71% of homes sold at or above list price—up from 69% in Q1 2024—and the average price per square foot increased to $580, up 2% from last year. Quick market movement also continues to be a theme, with 62% of homes going pending in the first 10 days.

Click here for the full report and neighborhood-by-neighborhood statistics!

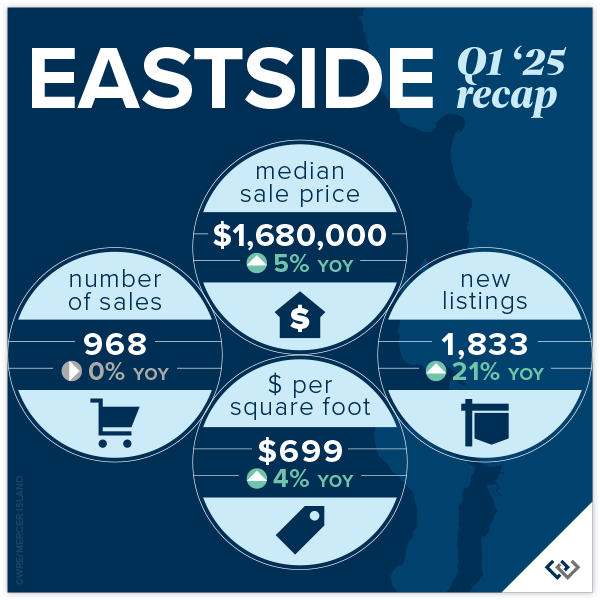

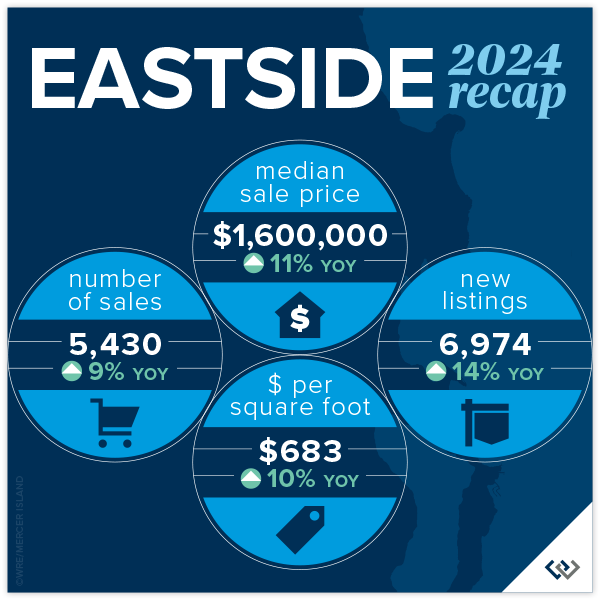

EASTSIDE

The Eastside market continues its upward momentum, with a 5% year-over-year increase in median sale price to $1,680,000 in Q1—building on the 14% jump reported in Q1 2024 and the remarkable recovery from Q1 2023’s $1,400,000 low. This marks a $280,000 increase over two years, a clear signal of sustained buyer demand and market strength.

Homes are moving quickly, with 69% selling in the first 10 days—up from 65% last year. Additionally, 72% of homes sold at or above list price, improving consistently from 68% in 2024. East Bellevue (E of 405) stood out with 83% of homes selling in the first 10 days and a 10% jump in median price—continuing its leadership in market competitiveness in recent years.

We also saw notable activity in Redmond, where sales rose 10% and 75% of homes sold in the first 10 days. Kirkland held strong as well, with an 8% increase in median price to $2.21M after last year’s 32% gain. And despite West Bellevue’s sharp 18% price dip, it remains one of the most valuable submarkets with a median price of $3,200,000.

The listing count jumped 21% year-over-year, with 1,833 homes hitting the market—finally turning a corner after multiple years of historically low inventory. Overall average price per square foot also increased 4% to $699.

Click here for the full report and neighborhood-by-neighborhood statistics!

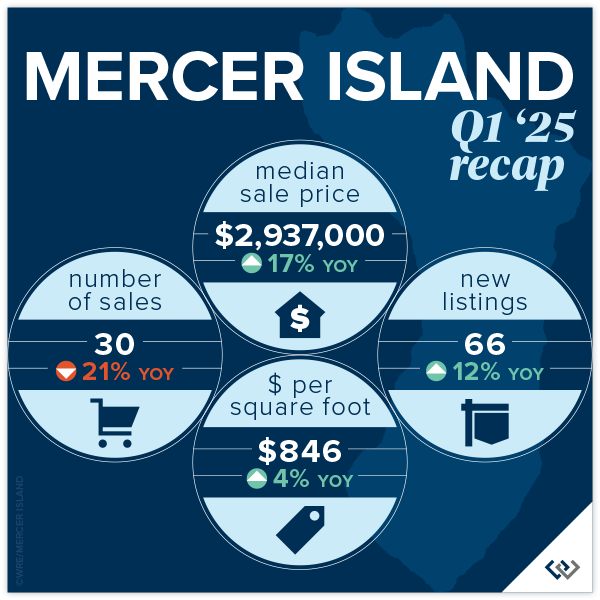

MERCER ISLAND

Mercer Island’s real estate market launched into 2025 with remarkable momentum. Median sale prices surged 17% year-over-year to $2,937,000—outpacing both Q1 2024’s 13% growth and 2024’s full-year 11% rise. This continued appreciation reflects strong buyer demand and an increase in high-value transactions across neighborhoods like Southend and Northend, which posted some of the highest median sales at $4,401,000 and $4,012,000 respectively.

While total sales volume declined by 21% from Q1 2024, due in part to seasonally low inventory, the market remained highly competitive. Over half (53%) of homes sold within the first 10 days—down from 73% in Q1 2024 but still a strong indicator of buyer urgency. Likewise, 47% of homes sold at or above list price, a notable drop from last year’s 65%, but consistent with Q1’s evolving pace as buyers exercise more discretion amid shifting macro conditions.

Inventory began to bounce back with 66 new listings—12% more than Q1 2024—signaling renewed confidence from sellers. Price per square foot rose modestly by 4% to $846, continuing the stable value trend seen in prior quarters.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

The condo market is off to a strong and balanced start in 2025. With a 15% year-over-year increase in Seattle’s median condo price—now at $635,000—and a 9% increase on the Eastside to $735,000, it’s clear that confidence is returning to this sector. Seattle posted a 19% rise in condo sales, while Eastside transactions grew 15%, building on the momentum established last year. Go Seattle Go! We’re always rooting for downtown condo recovery.

Woodinville condos were the breakout stars this quarter, with a remarkable 108% rise in median sale price and 41% more units sold. Likely due to new construction projects in wine country. Redmond followed suit, reporting a 27% price jump and 36% growth in volume. Meanwhile, West Bellevue remains the most expensive submarket at $1,045,000, despite some pricing fluctuations. Seattle’s North End also had a strong showing, with prices up 3% and more than half of condos selling at or above list price.

In terms of competitiveness, Mercer Island stood out with 80% of its (5) sales happening in the first 10 days—up from 52% last year. This level of demand echoes across the Eastside, where 44% of homes sold within 10 days, up from 39% last year. Seattle mirrored this pace with 35% selling in the first 10 days.

Inventory has expanded as well. New condo listings rose 34% over last year, providing buyers with more choice while keeping upward pressure on prices. The condo market is proving to be as unpredictable as all things in the US today. There are certainly bright spots and it we are cautiously optimistic that Home Shoppers are considering condos a realistic option, unlike years past.

Check out area-by-area details the full condo report.

WATERFRONT

Seattle led the pack with 10 waterfront sales in Q1 of 2025, including the highest sale in the region—an immense 15,321 square foot Magnolia home on over 3 acres and 293 feet of waterfront that sold for $21,500,000. All but 3 of Seattle’s waterfront homes sold within the first 10 days on the market with one Lake Forest Park home going for $160,000 above the asking price.

The Eastside also posted some impressive Q1 sales, including a $16m Hunts Point sanctuary and a $13.125m Italian-inspired stunner at Mercer Island’s southern tip. The most modest waterfront sale was an original 1968 beach house on 58 feet of lakefront in Bellevue that sold for $1,750,000.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Brooke Davis and Northwest’s Best Real Estate Video & Photography. Eastside cover photo courtesy of Joe C. Liu and Clarity Northwest Photography. Condo cover photo courtesy of Andrea Iverson and Andrew Webb, Clarity Northwest Photography.

Is Downsizing Right for You? Here’s How to Decide

Choosing to downsize is more than just moving into a smaller space, it’s about curating a simpler lifestyle that fits your current needs. Whether you’re retiring, looking for an eco-friendly, low-maintenance home, or wanting a fresh start after your children have moved away, downsizing might be the best option for you. Before making the move, here’s everything to consider.

Why Downsizing Could Be the Right Choice

Increased Cash Flow & More Financial Flexibility

Downsizing can offer significant financial benefits, starting with a smaller mortgage, which frees up extra cash for other needs or desires. Home insurance costs also tend to be lower, as the size of the home typically influences insurance premiums. Downsizing to less square footage can also lower property tax bills. Finally, a smaller home also leads to decreased utility bills, as the cost of heating and cooling a smaller home requires less energy expenditure.

More Time, Less Maintenance & Stress

Bigger homes call for more maintenance. Downsizing can help cut down time spent on household chores such as cleaning and vacuuming, which will give you more hours to do something more enjoyable. Homeowners who have successfully downsized often feel happier because they are no longer overwhelmed by the demands of a larger home. Less responsibility, less housework, increased cash flow, and flexibility equals reduced stress.

A Greener Lifestyle

After downsizing, homeowners commonly buy less since they don’t necessarily have the room for it. Reduced consumption not only leads to a more minimalist lifestyle but also cuts down on waste. Less waste plus less energy expended to heat and cool the space means a smaller environmental footprint and keeps your home green.

What You Might Miss When Downsizing

While moving into a smaller space has benefits, there are trade-offs to consider. A smaller home means less storage space, meaning you’ll need to give away or donate furniture, books, kitchen supplies, and other belongings that may not fit. Less space and fewer rooms can also make the home feel cramped, especially if you’re a long-term homeowner used to larger square footage.

Remote work may also become more challenging in a downsized home. Finding a quiet, dedicated workspace can be difficult, and close quarters may make it harder to stay productive. Additionally, hosting overnight guests or bigger holiday dinners might be out of the question for a smaller home. Adjusting to a downsized lifestyle can take time for those accustomed to more space, requiring new habits and a fresh approach.

Questions to Ask Before Making the Move

Before downsizing, it’s crucial to reflect on how less space in your home will impact your lifestyle. Think about your attachment to your current home’s size. Do you need extra rooms for guests or a second bathroom for convenience? Will moving into a smaller home feel too much like a step backward? Or will it bring the sense of freedom and simplicity you’ve been looking for? Ask yourself these important questions to ensure you’re making the right choice:

- What are my must-haves in a smaller home? Think about what you might miss from a more spacious home, or factors like location, accessibility, and storage solutions.

- How will my daily routine change? Consider how a smaller space might impact your hobbies, work setup, or ability to entertain.

- Does this move align with my long-term plans? Imagine the next 5, 10, or even 20 years, and start to question if a smaller home meets your future needs.

- How much will it cost to downsize? Factor in moving expenses, costs associated with selling, new furniture purchases, and the amount it will cost to store or sell belongings you no longer have space for.

- What will I do with sentimental or bulky items? Consider whether you’ll keep, donate, sell, or store them, and how much space you’re willing to dedicate to cherished belongings.

If you believe downsizing is the right option and are ready for the next step, you’re probably asking yourself, “Should I sell first or buy first?” When you’re prepared to discuss your options, reach out to me for expert advice:

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog.

Cut the Clutter: Donation & Recycling Locations Around the Sound

Spring is coming, and with it comes a chance to clear out the old and start fresh—whether it’s those ever-growing piles in your garage and attic, that closet you can barely close, or a horror-movie-inspired basement. Here are resources to reclaim your space and put your unwanted items to good use (or recycle and give them their own fresh start)…

Donations | Recycling | Disposal

Donations

CHILDREN’S HOSPITAL BARGAIN BOUTIQUE

Furniture/furnishings, jewelry, antiques, collectibles, and new or gently used men’s, women’s or children’s clothing. Be sure to check items they don’t accept.

seattlechildrens.org/giving/bargain-boutiques

Estates: (206) 327-3067

Vehicles: (888) 205-8941

Bainbridge Island: 1050 Hildebrand Lane, Suite G-1 | Bainbridge Island, WA 98110 | (206) 842-5567

Olympia: 2020 Harrison Ave. NW | Olympia, WA 98502-5097 | (360) 236-8245

GOODWILL

Accepts donations of a wide range of items, from exercise equipment, to clothes and home decor items and furniture. Net proceeds help fund job training and education programs.

evergreengoodwill.org/donate-goods

KIDVANTAGE

Donate your quality used children’s clothing, shoes, baby gear, toys, books, bedding, and maternity clothing. You’ll help to fill the nearly 4,000 orders of essentials that they provide to underprivileged children and expectant moms each week.

Issaquah: 1510 NW Maple St. | Issaquah, WA 98027 | (425) 865-0234

Shoreline: 17230 12th Ave NE | Shoreline, WA 98155 | (425) 209-1136

Bremerton: 1463 NE Dawn Road, Suite B | Bremerton, WA 98311 | (360) 616-0235

MARY’S PLACE

Gratefully accepts gently used clothing, luggage, twin size sheets/blankets, paperback books, and small household items (dishware, utensils, mugs, and small appliances such as microwaves) to distribute to families in need.

marysplaceseattle.org/get-involved/share-your-stuff

Donation Center: 4521 6th Ave S. | Seattle, WA 98108

Shelter (small donations only): 720 Blanchard St, Seattle

NORTHWEST CENTER

Big Blue Trucks accept clothing, household goods, sporting goods, tools, toys & more to support people with disabilities. Here’s what they do and don’t take.

bigbluetruck.org/drop-off-locations

NORTHWEST FURNITURE BANK

Furniture bank for homeless families in transition in South King County and Pierce County. Here’s what they accept and you can arrange a pickup if you live within a 25 mile radius of Tacoma.

117 Puyallup Ave | Tacoma, WA 98421 | 253-302-3868

SAINT FRANCIS HOUSE

Accepts clean, gently used clothing for men, women & children as well as kitchen & household items. All donations are passed on directly to those in need.

stfrancishouseseattle.org/support-us

169 12th Ave | Seattle, WA 98122 | 206-268-0784

SAINT VINCENT DE PAUL

Drop off your sorted donations of gently used clothing, housewares, toys, shoes/accessories, linens, books, and electronics to one of their thrift stores (here’s what they don’t accept). $0.89 of every dollar funds programs that provide neighbors with food, clothing, eviction prevention, case management, and more.

SEATTLE’S UNION GOSPEL MISSION

Accepts food, clothing, furniture, vehicles & housewares in their mission to support our homeless neighbors.

Distribution Center: 8226 South 208th Street, Suite G110 | Kent, WA 98032 | (206) 723-5700

Furniture Pick-Up: (507) 593-7024

Recycling/Disposal

E-CYCLE WASHINGTON

WA Department of Ecology’s free program for residents to recycle electronics (including TVs, computers, monitors, tablets, & more), with participating locations across the state.

FRIENDLY EARTH

Free recycling of electronics, flat screen TVs/monitors, appliances, BBQs, computers, lawn equipment/tractors, motorcycles, & more! Recycling with a fee for copiers/printers, refrigerators, A/C units, solar panels, & large rear-projection TVs. Paid data destruction available as well. Get the full scoop here.

1560 1st Ave S. | Seattle, WA 98134

(206) 367-4111

ONE GREEN PLANET

Free recycling of electronics, computers, copiers, printers, ink/toner, appliances, bikes/scooters, scrap metal, machinery, phones/chargers, & more. Recycling with a fee for appliances containing Freon, flat screen TVs, tapes/CDs/floppy disks, alkaline batteries, & X-ray film. Here’s the full list.

851 Houser Way North, Suite B | Renton, WA 98057

(425) 996-3513

RECOLOGY

With a zero waste goal, Recology stores accept hard to recycle items like CFL light bulbs, household batteries, hard-cover books, small electronics/appliances, block Styrofoam, and bicycles. Here’s the fee list for non-customers (if you’re already signed up for their curbside service, you can drop off limited quantities for free).

Issaquah: 317 NW Gilman Blvd, #22 | Issaquah, WA 98027

Highline: 15858 First Avenue S, #A100 | Burien, WA 98148

Shoreline: 15235 Aurora Ave. N | Shoreline, WA 98133

RUBBISH WORKS

Removal of nonhazardous materials for eco-friendly disposal—up to 50% of hauled away materials are recycled and the rest is donated when possible.

(888) 594-5078

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Are You Paying Too Much for Property Taxes?

OK nobody panic, but it’s almost…TAX TIME. For Washington State homeowners, this means you’ve probably received a little postcard letting you know your property’s assessed value and taxes due for 2025. Those with a mortgage on their home may be tempted to file this away and let the bank take care of it (after all, that’s what your mortgage escrow fund is for). However, everyone should take a close look no matter who is writing the check—you may be over-paying taxes if your home’s assessment is above fair market value. You or a loved one who is a low-income senior or disabled may also be paying too much if you haven’t taken advantage of available exemptions. Read on for solutions to these issues as well as important deadlines to keep you on track. (Looking for income tax tips, too? Check out this article for homeowners.)

Assessments & Valuation | Exemptions & Deferrals | Important Dates

Assessments & Valuation

Each county has an assessor tasked with appraising real property at its true and fair market value, according to the highest and best use of the property. Fair market value is defined as, “the amount that a willing and unobligated buyer is willing to pay a willing and unobligated seller.” While three appraisal methods are accepted, the most common approach is to estimate value based on sales of similar properties. This is known as the Market or Sales Comparison approach and is typically pretty accurate. In fact, it’s what real estate agents use when they prepare CMA valuation estimates.

However, the county’s assessed value can be incorrectly high for a number of reasons. For example, if your property suffered recent damage or depreciation that wasn’t taken into account (physical inspections are only required once every six years). The highest and best use might also be incorrect, such as vacant land that is assessed as develop-able but in fact cannot support a septic system.

If you feel your assessment is too high, there are a number of steps you can take. A good first step is to contact your local county assessor’s office. You can request copies of the comparable sales that were used to appraise your property’s value, and can also inform them of any errors or information that should have been taken into account. Disagreements are often settled at this level without any further action needed.

If you can’t come to a resolution with the assessor, the next step would be to file an appeal with your county’s board of equalization (BOE). If you or the assessor disagrees with the BOE’s decision, it can then be appealed to the State Board of Tax Appeals (BTA). In some cases, the decision made by the BTA can also be appealed in Superior Court. Keep in mind that any appeal you make will require you to provide market evidence that the assessed value does not truly reflect the fair market value.

Exemptions & Deferrals

Low-income senior homeowners who are age 61+ or people unable to work due to a disability (or their surviving spouses/domestic partners age 57+) may be eligible for a property tax exemption. This lowers the amount of taxes that are owed each year. For King County, the maximum income is $84,000 (find income guidelines for other counties here).

Seniors, low-income or disabled people who don’t meet the guidelines for an exemption may still be eligible for a property tax deferral. While this doesn’t reduce the taxes owed, it does allow you to defer taxes (including special assessments and back taxes) as a lien on the property that can be repaid either as funds become available or when the property is sold. 5% interest is assessed on the deferred amount.

Find application info plus more property tax relief programs in this article on Property Tax Relief Programs.

Important Dates

January 1st: Property is valued for taxes due in the next year.

March 31st: Applications are due for the Senior/Disabled Deferral and Widow/Widower Assistance.

April 30th: The first half of property taxes are due (or full amount if you owe less than $50).

May 1st: 1% per month (12% per annum) is assessed on any overdue taxes.

June 1st: A 3% penalty is assessed for any overdue taxes in the current year.

July 1st: Deadline to file an appeal with the County Board of Equalization (BOE) for the current year’s assessment (or 30 days from the date of notification if it’s later).

August 31st: New construction is placed on the assessment roll based on the valuation determined July 31st.

September 1st: Applications for the Limited Income Deferral are due.

October 31st: The second half of property taxes are due.

December 1st: An 8% penalty is assessed for any overdue taxes in the current year.

December 31st: Property tax exemption applications are due for seniors and those with disabilities.

For more info, contact the Washington State Department of Revenue at dor.wa.gov or (360) 705-6705. You can also find a lot of great info in their Homeowner’s Guide to Property Tax publication.

Psst…I love giving you these helpful tips but they can’t replace the advice of your tax professional. Reach out to your pro for counsel on the best course of action for your unique situation.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

How’s the Market? Annual Real Estate Review for the Seattle Area

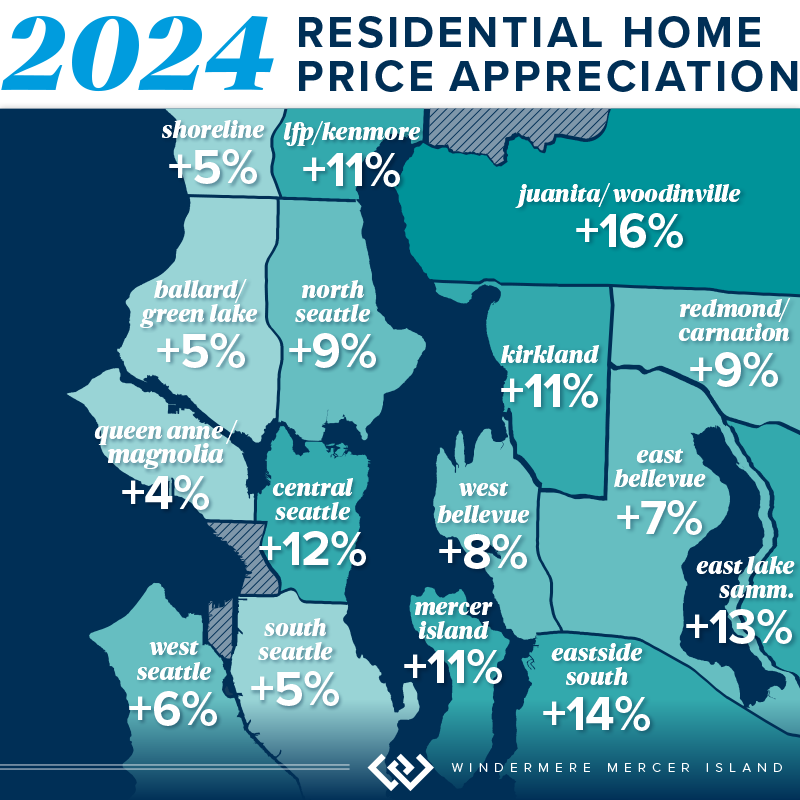

Happy New Year! Whew, we made it! With 2024 now in the books, we’re looking back fondly on a real estate market that showed positive signs of growth in virtually every sector. Median sales prices posted strong double-digit gains on the Eastside along with a healthy 8% rise in Seattle. Listings also rose, easing the strain for buyers grappling with our housing shortage.

If you’ve waited long enough and 2025 is the year for you to make a move, we recommend front loading that decision. Pent up demand (both sellers waiting to sell and buyers waiting to buy) should give us a spring full of blossoming and beautiful inventory. There is less volatility in interest rates than there has been in recent months, you’ll see that the average rate has been rock steady around 6.75% in 2023 and 2024. Overall, this is a great time to buy or sell and I am excited to help you!

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

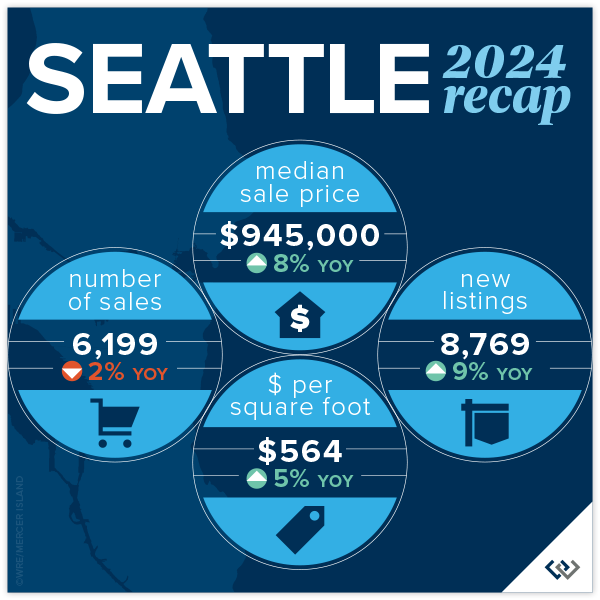

SEATTLE

From a statistical/real estate perspective, the numbers don’t really reflect the overall vibe of the year. In a good way! It’s all positive news: prices are up, listings are up, and market time is down. The City of Seattle is in full recovery mode. Homeowners are awaiting the new density plan and eager to learn what the city has in store for the core neighborhoods around transit. It’s an exciting time. Median sold price city-wide reached a record $945,000 (modest, as that is $5000 above the previous record set in 2022) and homes sold for an average 104% of list price when they attracted a sale in the first 10 days (58% of the total sales).

Lake Forest Park and Madison Park saw the greatest price gains at 11% and 12% respectively. North Seattle was over all the “strongest” with 66% of homes selling in the first 10 days and 70% of homes selling for at or above list price. There was a modest gain in new listings across the board at 8769, while still lower than typical. The ten-year average is around 10,500 listings per year. No bad news here with average price per square foot gains of 5% to $564!

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

Welcome 2025! We (the real estate community) are feeling hopeful and bullish about what’s to come. So far, the numbers year over year support that. When we reviewed 2023 for the Eastside, the only positive statistic reported was Mercer Island’s 2% rise in the number of home sales. Looking at the 2024 report with that perspective it is ALL good news. New listings are up 14% for the year, while the number of sales are up nearly 10%. This is absorption of inventory to be excited about. Prices are up 11% to a record high of $1,600,000!

Woodinville and the area S of I-90 saw the largest price gains at 16% and 14% respectively, likely enjoying the benefits of buyers ‘pushing out’ because of the pressure of affordability in the core neighborhoods. Kirkland and West Bellevue were among the highest total sales and still a strong showing in price gains at 11% and 8%. Even though Bellevue (E of 405) saw the most modest price gains this was arguably the most popular neighborhood with 74% of homes selling in the first 10 days and 71% selling for at or above asking price!

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

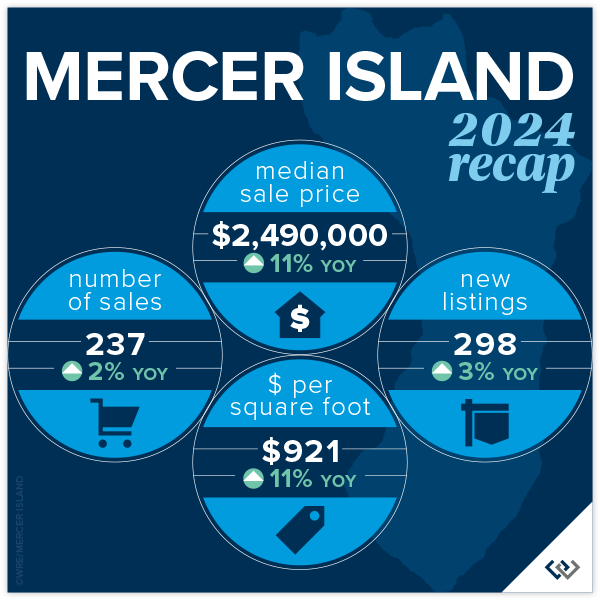

MERCER ISLAND

2024 was a solid year for Mercer Island: 11% overall price growth, on average 98% list to sales price ratio, and a respectable 32 cumulative days on market. This was a year of calm and confident decisions made by the entire real estate market. Home buyers and sellers alike. Looking to the neighborhoods there were two that stood out in relation to 2023: The Eastside and The Lakes where total sales had massive growth. 26 homeowners (vs 11 in 2023) moved on the Eastside and in the Lakes there were 4 transactions, a whopping change given that there were no sales reported on the MLS in 2023. The Island has not yet reached the peak prices from 2022, but we’re on our way!

Shifting to the condo market, 2024 was a sleepy year. With 47 new listings and 33 sales (both about 20% lower than in 2023), the average list to sales price ratio of 101% surprised us! Total median price is down YOY by about 8%, but with such little data to draw from this number tends to swing more than most. The overall price swing was from $339,000 for a studio to $1,775,000 for a 2 bedroom luxury unit. 19 of the 33 sales were 2 bedroom units. All in all condos on the island are a necessary market segment that we continue to watch closely as an overall indicator of market health.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

In reviewing last years’ report, there was so much RED! This year is a refreshing change with some positive numbers sprinkled in. Even the pockets that remain flat feel like good news, after all, a push is a win! Perspective is everything, in life and in real estate. This year was absolutely a bright spot for condos in the last several months. This was due in large part to external factors: affordability issues in single family, perceived ‘high’ interest rates, continued density issues in the ‘burbs, and major employers recall to office. Urban life in both Seattle and on the Eastside are experiencing a renaissance and we’re here for it!

The headline in Seattle is that prices are UP! Downtown saw an increase of 8% to a median price of $650,000. Though, North Seattle carried the day with an eye popping 18% increase in median price. While price per square foot was flat on average, new listings are up 21% YOY. Sellers are dipping their toes back in the market at higher prices (up 5.3%) and seeing moderate success with total sales down 3% (compared to a 26% drop in 2023). Buyers know they have options and will wait to pick off the low hanging fruit: best perceived value for their dollar.

Meanwhile, on the Eastside: prices are up, listings are up, sales are up. A nice headline, but let’s break it down. New listings rose a whopping 34% year over year (which you may remember saw a 23% dip from 2022). Demand was steady with total sales up 15% YOY; we didn’t quite absorb all of the new inventory but that is to be expected. So, even with a relatively high absorption rate prices rose to a record high median of $695,000. The stars of this price gain are, not surprisingly, Kirkland and West Bellevue at 28% and 24% respectively. We can’t wait to see what 2025 will bring!

Check out area-by-area details the full condo report.

WATERFRONT

The Eastside saw a huge boost in waterfront sales with 50% more sold in 2024 than 2023. Mercer Island and Lake Sammamish posted similar sales gains of 45% and 43% respectively. While Seattle had 2 fewer sales than the year prior, its waterfront homes sold faster than in any other area and fetched higher selling prices as compared to list prices.

The highest waterfront sale was $38,900,000 for an immense 13,590 sq. ft. Medina estate on 117 feet of Lake Washington shoreline. The most modest sale was $1,400,000 for a 1960 Ralph Anderson original on Seattle’s Arroyo Beach.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Michael Fleming and Clarity Northwest Photography. Mercer Island cover photo courtesy of The Sirianni Group and Clarity Northwest Photography. Condo cover photo courtesy of Luke Bartlett and Matthew Gallant, Clarity Northwest Photography.

Selling Your Home: 5 Common Myths

Selling your home is a crash course in real estate education. My clients learn a LOT as we work together to find a buyer and sell at the right price. As you prepare to sell, it’s important to remember that that not everything you’ve heard is true. There are several common myths that can lead to costly mistakes in the selling process. Knowing the truth behind them will clarify your selling journey and help you align your expectations…

Myth 1: Home Value Calculators Are 100% Accurate

Online Automated Valuation Models (AVMs) are a great starting point for understanding how much your home could be worth. However, they are merely a first step in determining home value; to say they are 100% accurate is a myth. When it comes to pricing your home, you need to rely on a true Comparative Market Analysis (CMA), which uses vast amounts of historical and current data on real estate listings to arrive at an accurate and competitive figure.

To get an estimate of how much your home is worth, try our Home Worth Calculator here:

Myth 2: Selling FSBO Will Save You Money

Selling a home requires an intimate knowledge of the housing industry and how to solve the complex situations that arise throughout a real estate transaction. Despite this, some sellers will go it alone and attempt to sell their property without being represented by an agent.

Selling For Sale by Owner (FSBO) is a risky proposition. It requires the seller to bear added liability, fills their schedule with various marketing and promotional responsibilities, and can leave money on the table by inaccurately pricing the property, causing it to sit on the market for too long. The potential costs of selling a home on your own far outweigh the commission real estate agents earn on a home sale.

Myth 3: You Must Remodel to Sell Your Home

The question you’ll face when preparing to sell your home is whether to sell as is or remodel. The answer usually lies somewhere in between, but it depends on your situation and what kinds of home upgrades are driving buyer interest locally. When making improvements to your home, lean toward high ROI remodeling projects to get the best bang for your buck, and avoid trendy projects that can delay listing your home. If you’re considering major upscale renovations, talk to me about which projects buyers in your area are looking for.

Myth 4: Never Accept the First Offer

You’ve likely heard tell that the first buyer’s offer is nothing more than a springboard to up your asking price and to never accept it. In this case, “never” should be approached with caution. In reality, the best offer for your home is one that you and your listing agent have discussed that aligns with your goals. If a matching offer happens to be the first one that comes your way, so be it. The market can shift at any time, so you never know what may happen if you leave an offer on the table. And if the buyer backs out of the deal, you and your agent will find a path forward.

Myth 5: Home Staging Doesn’t Make a Big Difference

Staging your home is so much more than a cosmetic touch-up; it has been proven to help sell homes faster and at a higher price than non-staged homes.1 Staging ensures that your home has universal appeal, which attracts the widest possible pool of potential buyers. When buyers are able to easily imagine living in your home, they become more connected to the property. You should stage your home regardless of your local market conditions, but it can be especially helpful in competitive markets with limited inventory where even the slightest edge can make all the difference for sellers.

Now that you know some of the most common myths in the selling process, get to know its truths. Connect with me to get the process started:

1: National Association of REALTORS® – Why Home Staging Inspires the Best Prices in Any Housing Market

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link