5 Home Design Trends for 2026

In looking ahead at interior trends for this year, it’s clear that 2026 is all about the vibes. Creating warm, genuine spaces that reflect your individual lifestyle and create a mood is much more “in” than passing fads that rely on strict aesthetic rules. Rich colors, handmade textures, and grandma-inspired patterns are infusing into rooms once prized for their understated minimalism. Here are five trends to try incorporating into your home…

Rich, Moody Colors

Warmer, nature-inspired colors continue to dominate the palette but are moving deeper and more saturated. In looking at the top colors of the year chosen by leading paint brands, earthy and nostalgic tones such as chocolate brown, burgundy, and khaki all make a prominent appearance. Moss and blue-greens also continue their popularity. On the lighter end of the spectrum, the neon pinks, blues, and greens that peaked in 2024 have now all softened into powdery pastels. Mauve is also making a comeback.

The monochromatic tonal trend is also shifting toward “atmospheric color,” where varying but closely related hues are carried across walls, furniture, and textiles to set a certain mood. It could be energetic reds and oranges for a fitness room; soothing pastels for a bedroom; or rich browns and plums for a comforting study. “Color drenching” takes it one step further by carrying a single bold shade or pattern across walls, ceilings, draperies, and trim. For inspiration, draw from the color families in Sherwin-Williams’ Colormix 2026 forecast.

“Grandmillennial” Style

Continuing on the trajectory of comforting, nostalgic interiors, this movement revives the old-school design fads that millennials fondly remember from grandma’s house. Rather than stiff, polished traditionalism, however, this new take is quirky and deeply personal. Vintage floral patterns are mixed together and layered throughout upholstery, rugs, draperies, and, pillows…perhaps with some skirted chairs, shapely wooden arms/legs, ruffles, buttons, cording, or tassels thrown in. Personal mementos and thrift store finds like mismatched antique furniture, classic art, and stained glass lighting further the lived-in feel (and are a sustainable source of style). Modern touches mixed in keep the room feeling coordinated rather than chaotic…you can also try sticking to a color family repeated throughout the room, and having a base of neutral solids.

Small Moment Spaces

While the closed room layouts of the 90s have remained solidly out of style, designers are finding ways to reclaim dedicated spaces within the open layout. This can be done through niches, soft partitions like curtains, or pocket doors. Think cozy reading nooks; highly decorated “jewel box” seating niches layered with sumptuous colors and textiles; built-in desks or bookshelves at the end of the hallways; and semi-separated bedroom sitting areas reminiscent of a boutique hotel room.

The Fifth (and Sixth) Walls

Where accent walls were once all the rage, we’re now seeing accent ceilings take their place. Bold colors, hand-painted frescoes, and even wallpaper overhead add immediate interest to a room. Floors are following in their wake with bold patterned tiles or rugs adding yet another dimension of variety. Try this in a small space like a hallway, bathroom, or bedroom. Box ceilings can also make a fun canvas for accent colors. Not quite ready to take the plunge? “Color capping” is a more subtle version of this trend with colors gradually deepening toward the ceiling, which is painted a slightly darker shade of the same wall hue.

Personal Retreats

Wellness and relaxation have remained priorities for homeowners in the years following the pandemic, and now we’re seeing a rise in private sanctuaries that go beyond (or complement) the basic home gym. These can be anything from pocket size meditation rooms to spa-like recovery rooms complete with saunas and cold plunge pools. Clean, warm wood finishes and natural light are often utilized to create a biophilic sense of calm.

Curious about how to incorporate the latest home trends before you sell? Our agents see the latest home styles every day. Reach out for advice!

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2026, Windermere Real Estate/Mercer Island.

Strategic Investments to Boost Value & Curb Appeal

When it’s time to sell your home, one of the biggest questions is how to make it as appealing as possible to today’s buyers. While market conditions, location, and timing all play a role, the updates you choose before listing can make a meaningful difference in both your selling price and how quickly your home goes under contract. The key is knowing where to invest your time and money. Not every project pays off, but some smart upgrades can give your home a competitive edge, help it stand out in online listings, and create the kind of first impression that gets buyers excited.

Here are some of the most impactful ways to invest in your home before putting it on the market.

Fresh Paint and a Neutral Palette

Few improvements have a more substantial return on investment than paint. A fresh coat instantly refreshes a space, making it feel clean, updated, and well-maintained. In fact, a recent report1 by the National Association of REALTORS® found that painting is the #1 project agents recommend sellers do before selling.

Neutral tones for interiors, such as light beige, soft grays, and crisp whites, appeal to the broadest audience and allow buyers to envision their own style in the home. Check out the Sherwin-Williams Colormix Forecast 2026 for some up and coming hues (and opt for the lightest shades). It’s crucial not to overlook trim, doors, and even ceilings, as these small details help create a polished, move-in-ready feel. And if your front door could use a pop of personality, consider a bold, welcoming color that complements the rest of the exterior.

Curb Appeal That Counts

Buyers often form an impression before they even step inside. Landscaping, exterior lighting, and simple maintenance go a long way toward making your home inviting. Think trimmed hedges, fresh mulch, pressure-washed walkways, and a tidy lawn. It’s also smart to ensure outdoor areas are safe, from repairing uneven paths to addressing any obvious hazards. Here is a printable checklist so you don’t miss anything.

Adding planters with seasonal flowers, updating house numbers, or swapping out an old mailbox can elevate your home’s appearance without requiring a significant investment. For buyers scrolling through listings, that curbside charm can be a deciding factor that gets them to schedule a showing.

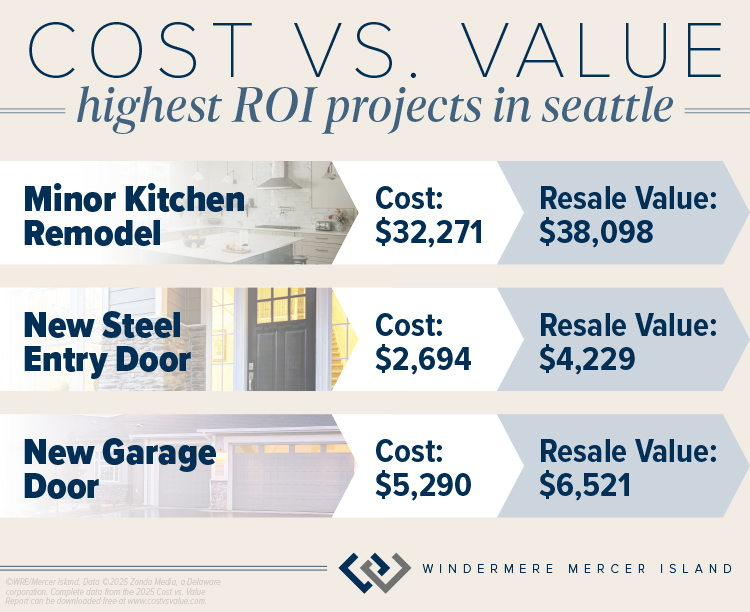

According to the latest Cost vs. Value report for Seattle2, exterior curb appeal investments such as a basic new front door or garage doors can net you a profit when it’s time to sell:

Kitchen and Bathroom Touch-Ups

Kitchens and bathrooms continue to be high priorities for buyers, but you don’t need to take on a full remodel to make an impact. Small upgrades like replacing outdated cabinet hardware, installing new light fixtures, or swapping in modern faucets can transform the look of these spaces.

In the kitchen, consider updating your backsplash with a clean, timeless tile or refreshing worn countertops with a durable surface. In bathrooms, re-grouting tile, caulking any cracks, replacing mirrors, or updating vanities are simple ways to modernize without overspending.

The Cost vs. Value report2 also found that the kitchen can be a smart place to invest in a minor remodel of surfaces and newer mid-priced appliances and fixtures. In the Seattle area, a minor remodel is estimated to recoup 118% of its cost when you sell.

Flooring Matters

Floors are often one of the first things buyers notice when touring a home. If your carpets are worn or stained, professional cleaning or even replacement can make a big difference. Hardwood floors are especially appealing and refinishing them is often more cost-effective than replacing them.

For areas where replacement makes the most sense, consider durable and stylish options like engineered wood or luxury vinyl plank. Consistent flooring throughout the main living areas can also help a home feel more spacious and cohesive.

Energy-Efficient Features

Today’s buyers are increasingly focused on efficiency and sustainability. Investments like LED lighting, programmable thermostats, and updated appliances not only lower utility bills but also signal to buyers that the home is modern and thoughtfully maintained.

If your budget allows, new windows or improved insulation can add value while appealing to environmentally conscious buyers. Highlighting these upgrades in your listing helps showcase both comfort and cost savings.

Decluttering and Staging

Sometimes the most impactful upgrade isn’t about new finishes, it’s about presentation. Decluttering each room, minimizing personal items, and rearranging furniture to optimize space can dramatically change how buyers perceive your home. Here’s a printable checklist to help. And the best part? It’s completely free.

Professional staging takes this one step further, creating a warm and welcoming atmosphere that helps buyers envision living in the space—it can also help your home sell faster and for more money according to a 2025 report3. Even small touches, like fresh flowers, cozy throws, and well-placed artwork, can make your home feel more stylish, comfortable, and truly move-in ready.

Making Smart Choices

The goal of any pre-sale investment is to spend strategically, choosing projects that increase appeal without overextending your budget. You can also refer to this article on what NOT to do.

As a Windermere agent, I’m an expert at helping sellers decide which upgrades matter most. From recommending paint colors to connecting you with trusted contractors, I’m here to make sure you get the best return on your investment. Through our Windermere Ready program, we can even front the cost of improvements like painting, landscaping, cleaning, and staging so your home shines its brightest when it hits the market. With concierge-level service and no payments due until closing, it’s a simple way to maximize your home’s value and sell faster.

Connect with me today to learn more about how I can help you prepare your home for the market with confidence:

Adapted from an article that originally appeared on the Windermere blog October 1, 2025.

1Copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

2©2025 Zonda Media, a Delaware corporation. Complete data from the 2025 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2026, Windermere Real Estate/Mercer Island.

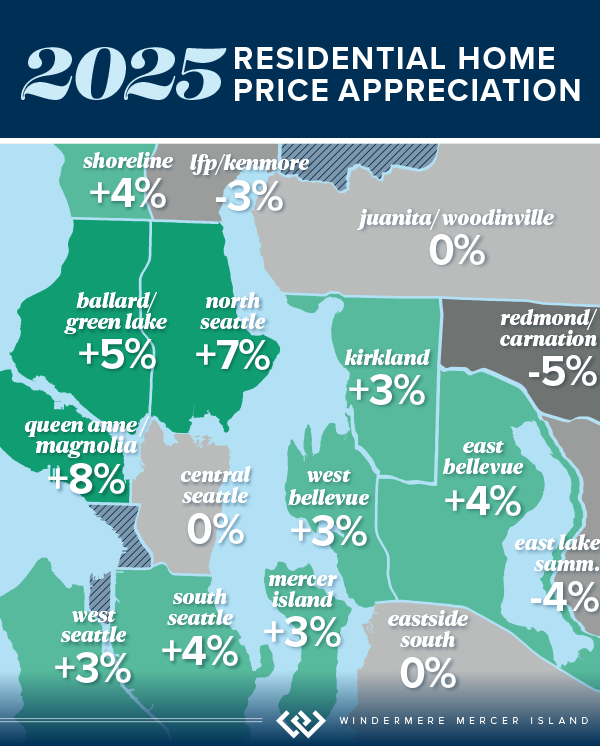

How’s the Market? Year End Review of Seattle Area Real Estate in 2025

Home values held steady in 2025 with many communities seeing modest price gains. Seattle Metro’s median sale price and $ per sq. ft. both rose year-over-year, while the Eastside’s numbers remained similar to what we saw in 2024. Both areas saw double-digit spikes in the number of new listings and a slight slowdown in the number of sales.

Looking forward: this is a great year to invest! We’ve had a few back-to-back years of soft price gains, which feel like losses in our frequently HOT Seattle. This is as close to a “buyer’s advantage” market as we’ve seen in years. At the time of writing this, interest rates are available in the high 5’s. The cost of money is reasonable and the cost of property has not risen drastically in a few years. This is the perfect time to jump in for investors and first-time buyers. More specifically, anyone who can buy “unburdened” or without having to sell/carry two mortgages in order to buy. The condo and townhome markets continue to be a great opportunity for those looking to take the first step onto the property ladder. If none of this applies to you, remember: if you’re looking to buy and sell within the same market, you only get an advantage on one side.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

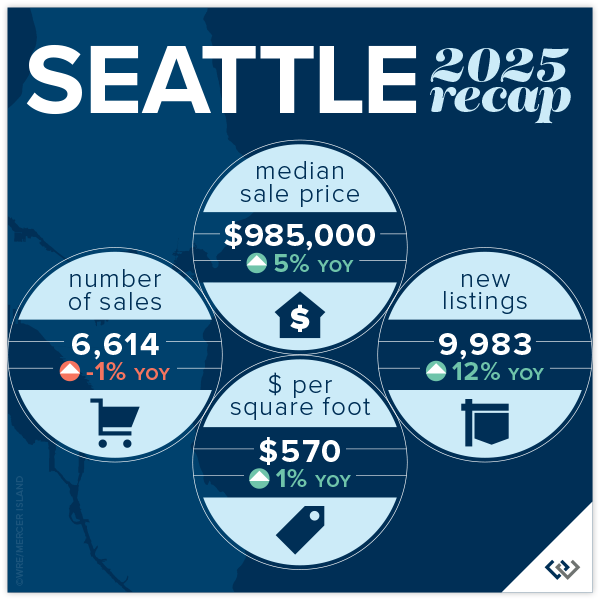

SEATTLE

It’s all good news in the city of Seattle! The median price rose by 5% to $985,000. Pricing remained competitive, with 64% of homes selling at or above their list price (despite the fact that new listings increased 12% from 2024 and the number of sales dipped slightly).

Sales activity moved quickly in many neighborhoods. Citywide, 55% of homes sold within the first 10 days on market. Several areas posted strong performance, including Ballard & Green Lake with 1,705 homes sold, and North Seattle with 1,040 sales. Median prices varied by neighborhood, ranging from $794,000 in South Seattle to $1,399,000 in Queen Anne & Magnolia, reflecting the diversity of Seattle’s housing market.

Remember, these statistics include new construction data. In an inventory-constricted market, new construction data can skew pricing stats significantly. Check with your agent for how this affects your neighborhood.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

Across the Greater Eastside, 5,458 homes sold during the year, down 5% compared to 2024. New inventory increased, with 8,259 new listings coming to market—up 16%! Fifty-five percent of homes sold at or above their list price, and 53% sold within the first 10 days on market, highlighting consistent transaction pace and buyer confidence across the region. Despite this, the median sale price held flat at $1,599,000 compared to 2024, while homes sold for an average of $688 per square foot, also similar to last year.

Several communities recorded notable activity levels, including Woodinville with 1,235 homes sold and East of Lake Sammamish with 1,134 sales. East Bellevue saw a 13% increase in homes sold, while Redmond posted a 15% increase in sales volume. Median sale prices varied by community, ranging from $1,281,000 in Woodinville to $3,688,000 in West Bellevue, reflecting the diversity of the Eastside housing market.

Several communities recorded notable activity levels, including Woodinville with 1,235 homes sold and East of Lake Sammamish with 1,134 sales. East Bellevue saw a 13% increase in homes sold, while Redmond posted a 15% increase in sales volume. Median sale prices varied by community, ranging from $1,281,000 in Woodinville to $3,688,000 in West Bellevue, reflecting the diversity of the Eastside housing market.

Click here for the full report and neighborhood-by-neighborhood statistics!

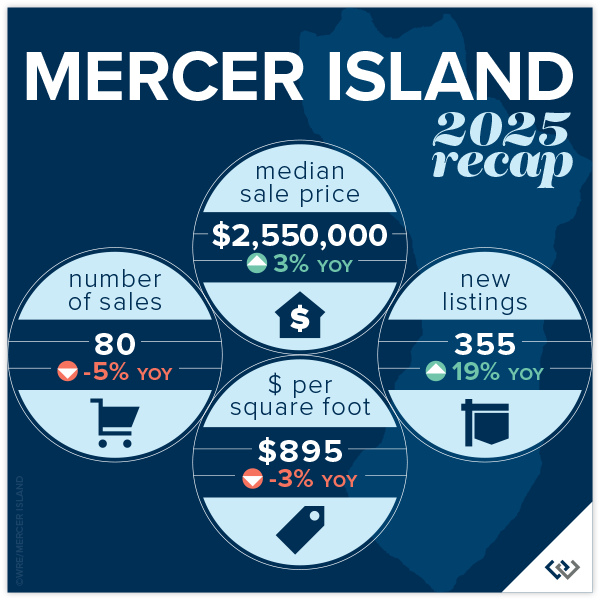

MERCER ISLAND

The 2025 Mercer Island real estate data reflects a year of steady activity and modest price gains. Median home prices rose 3% year over year to $2,550,000. Homes sold for an average of $895 per square foot, and half of all homes sold at or above their list price. Sales moved efficiently, with 56% of homes selling within the first 10 days on market.

A total of 80 single-family homes sold on Mercer Island during the year. Activity varied by neighborhood, with sales recorded across Northend, Southend, Mid-Island, First Hill, Westside, and The Lakes. Median home prices ranged from $1,775,000 in Mercerdale to $5,831,000 on the Westside, highlighting the range of housing options across the island.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

The 2025 Condo Report shows steady, encouraging activity across both the Seattle and Eastside condo markets. Year over year, condo sale prices increased a combined 2% to a median of $630,000, with homes selling for an average of $633/sq.ft. Half of all condos sold at or above their list price, signaling stable buyer demand. Inventory also expanded, with 8,331 new condo listings—up 14% from 2024! This is great news, increased supply that didn’t cause a price ‘dump’, it shows our Buyers may be returning to confidence around condos.

In Seattle, 2,695 condos sold during the year, a 9% increase in sales volume. The median Seattle condo price rose 2% to $585,000, and 51% of homes sold at or above list price. On the Eastside, 2,050 condos sold, with median prices increasing 5% year over year to $730,000. Eastside condos averaged $643 per square foot, with 51% selling at or above list price and 36% selling within the first 10 days. The market showed a combined 52 average days on market, with a 99% list to sales price ratio. Though, when original list to sales price ratio is compared the average sits at 97%. This means that patience and active calibration are both required when marketing your condo.

Mercer Island’s condo market also trucked along with 27 sales and a slight 1% year-over-year boost in median prices. Condos sold for an average of $591 per square foot, up 13% over 2024. Thirty-seven percent of condos sold at or above list price, and within the first 10 days. Inventory expanded as well, with 355 new condo listings, up 19% from 2024.

Check out area-by-area details in the full condo report.

WATERFRONT

Seattle saw a boost in the number of waterfront sales in 2025, with 36 compared to 31 in 2024. Lake Sammamish sales were similar to last year (31 vs. 30 in 2024), while Mercer Island and the Eastside both saw slight dips their sales numbers.

Mercer Island had the highest waterfront sale of the year at $25 million for a nearly 10,000 sq. ft. European Modern home on 102 feet of prime west-facing North End waterfront. The most modest sale was in Bellevue at $1.75 million for an original 1960s beach house on 50 feet of lakefront.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

View the full waterfront report

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2026, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed.

Housing Forecast: 6 Predictions for 2026

The following is a summary of Windermere Principal Economist Jeff Tucker’s six predictions for the U.S. housing market and economy in 2026. He goes into more detail about his predictions in the video below.

1. Existing Home Sales Will Pick Up (Barely)

Home sales have hovered near generational lows for three years. While a sharp rebound is unlikely, conditions point to a modest uptick in 2026. Inventory levels are higher than they’ve been since 2019, and mortgage rates are lower than they’ve been since 2022. Together, those factors should lift existing home sales—but not by much.

2. Home Prices Will Be Roughly Flat

Home prices are likely to remain flat in 2026, largely due to higher inventory putting downward pressure on values. The Case-Shiller Home Price Index showed small declines last summer, though that trend faded by fall. Sellers have been highly responsive to market shifts, often de-listing when offers fall short or holding off on listing altogether. That restraint has kept prices from falling further despite growing supply

3. Inventory Will Climb to Pre-Pandemic Levels

The number of homes for sale will likely return to pre-pandemic levels in 2026, possibly as early as spring. Inventory rose sharply in 2025, and a “shadow supply” of homes—those whose owners are waiting for better conditions—remains in the wings. Many “discretionary sellers” will continue testing the market, holding out for the right price. That behavior should extend average time on market and boost total listings, giving buyers more options and negotiating power.

4. The Homeownership Rate Will Decline

At current prices and interest rates, homeownership remains out of reach for many middle-class Americans who would have bought in different conditions. Slower rent growth has also reduced urgency among would-be buyers, encouraging them to stay put. More renters are opting for single-family homes to enjoy the space and lifestyle of ownership without a mortgage, a shift that will help push the overall homeownership rate slightly lower.

5. Mortgage Rates Will Decline Slightly

Mortgage rates should remain below 6.25% for most of 2026 and could briefly dip under 6%. The Fed’s rate cuts and slower growth have brought 10-year Treasury yields near 4%, while the spread between Treasuries and mortgage rates has narrowed toward its normal range of 2% or less. That trend is expected to continue as refinance risk on mortgage-backed securities gradually fades, but much of the improvement is already reflected in current rates, so significant declines are unlikely.

6. We Will Avoid a Recession in 2026

The U.S. economy weathered several shocks in 2025 but avoided a downturn. Payroll gains have slowed, though more due to shrinking labor supply than weak demand, and unemployment claims have remained stable. After early trade policy turbulence, corporate earnings rebounded strongly, and tariff concerns have faded as court challenges and new trade deals rolled back some of the costliest restrictions.

This article originally appeared on the Windermere blog December 2, 2025.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Renting vs Buying: Which is Better for You?

Knowing whether it’s the right time to rent or buy depends on your buying power, what you’re looking for in a home, your local market conditions, your plans for you and your household, and the responsibilities you’re prepared to take on at your residence.

Renting gives you greater flexibility to relocate, fewer home maintenance responsibilities, and can often be more the more affordable option, depending on where you live. The extra costs associated with owning a home—interest payments, taxes, repairs—may be too much for some renters to handle.

Becoming a homeowner also has its advantages. From a financial standpoint, owning is usually better than renting in the long term—it allows you to build wealth as your property gains equity; your monthly payments are stable and actually become more affordable over time relative to your income; and some of the costs may be deductible at tax time. From a lifestyle standpoint, owning also affords you greater freedom to customize your living space.

Ultimately, the right decision depends on your situation. If you don’t plan to be living in the same place for at least five years, renting might be more logical, as it allows you more flexibility when it comes time to move again. If you’re looking to settle down for the better part of a decade or longer and can afford to buy a home, becoming a homeowner may be the better option. Here are a few additional considerations to guide your renting-versus-buying decision making process.

What are the local real estate market conditions?

Investigate the local sales and rental markets to get an idea of both typical home prices and the average monthly payment for a rental. When comparing housing costs, be sure to base your evaluation on what’s happening in your city and neighborhood, not the nationwide averages. I track these stats regularly, so feel free to contact me for an accurate update on prices in your neighborhood.

For a quarterly breakdown of local market conditions in the Seattle area, explore my Market Review page. Each report breaks down the latest figures in home sales, home prices, and days on market for regions throughout Seattle and the Eastside. They also include helpful insights and data analysis.

What can you afford?

Making the jump from renter to homeowner is often a question of affordability. Your mortgage rate will depend on your financial strength, your credit score, and other factors, so make sure to talk to a loan officer before you start looking for a home. Getting pre-approved for a mortgage will identify what you’re able to afford and helps strengthen your offer when the time comes.

To get an idea of what you can afford, try these Financial Calculators. You can estimate your monthly payment for any listing price/mortgage terms to get a well-informed picture of whether it’s the right time to buy.

Will you need to make repairs to your new home?

Buying a fixer-upper may seem like a great way to get a deal on a house, but if the money you spend on the repairs is too great, your profit could be diminished when it comes time to sell. The same is true for remodeling and improvement projects. There are various renovation financing loans available to you that can help with the costs of home repairs, though extra consultations, inspections, and appraisals are often required in the process of securing these loans. Ultimately, if you can only afford a home that demands major improvements, and you don’t have the skills to do much of the work yourself, you may be better off renting.

Can you rent part of the house you’re buying?

If you buy a house with rental-capable space (extra bedroom, mother-in-law unit, etc.), you could use the rental income to pay off your mortgage faster and contribute more to your savings. But, of course, you need to be willing to share your home with a tenant and take on the responsibilities of being a landlord or working with a professional property manager to help you with those duties. Renting out a space in your home will also require you to purchase landlord insurance on top of your existing homeowners insurance policy.

Making Your Decision to Rent or Buy

At the end of the day, the decision is up to you. Based on the conditions laid out above, it simply may not be the right time for you to buy. Fortunately, when it comes to being a homeowner, it’s not now or never. I’m happy to be your resource in gauging whether it’s the right time to buy and guiding you through the process toward homeownership. To get started, connect with me today.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere blog April 11, 2022.

Adding an ADU? Here’s a Guide to Permits & Regulations…

ADUs and DADUs are increasingly popular among homeowners looking to maximize their property value. For many cities in Washington State, the recent enactment of House Bill 1337 has made it easier for homeowners to add an ADU/DADU by loosening restrictions on them in residential areas. Other states have enacted similar laws as municipalities across the country try to address our shortage of “middle” affordable housing.

As the movement of short-term rentals, turnkey properties, and real estate investment continues to grow, it’s worth it to take a moment and understand the regulations that dictate a property’s potential—especially before you buy. Understanding a bit about the permitting process will also help you avoid getting bogged down in legalities when trying to build structures on your property.

What is an ADU, and do I need a permit to build one?

Accessory Dwelling Units (ADUs) and Detached Accessory Dwelling Units (DADUs) are essentially guest quarters that offer independent living space for renting out or accommodating multi-generational family members. Typically, they include a separate entrance, kitchen, living area, bedroom, and bathroom. Common examples are a basement apartment, converted garage, backyard cottage, or prefab modern shed. They’re a great way to get the highest return on your property investment. Before you break ground on your building project, however, here are some of the things you should keep in mind.

Accessory Dwelling Units (ADUs) and Detached Accessory Dwelling Units (DADUs) are essentially guest quarters that offer independent living space for renting out or accommodating multi-generational family members. Typically, they include a separate entrance, kitchen, living area, bedroom, and bathroom. Common examples are a basement apartment, converted garage, backyard cottage, or prefab modern shed. They’re a great way to get the highest return on your property investment. Before you break ground on your building project, however, here are some of the things you should keep in mind.

- Permits and Regulations: No matter where you live, it is necessary to obtain an appropriate permit before you begin the construction/conversion process. Permits ensure that your project complies with local building codes and regulations (and also allow you count that square footage as living space when you sell the property or have it appraised). Here are ADU regulations for King County, or check with your local city/county.

- Code Compliance: Building codes aren’t just red tape for the sake of red tape; they exist to make sure that all buildings are safe. Whether you’re building the structures on your property yourself or hiring a professional to do the job, familiarize yourself with your local codes and regulations. In the city of Seattle, HB 1337 allows homeowners to build at least two 1,000 sq. ft. ADUs per lot (whether attached or detached). Contact your local zoning department or building authority to learn more.

- Applying for a Permit: The permit application process varies by location. Typically, you’re required to submit detailed plans for your project with documents that outline its scope, size, etc. Whether you submit architectural drawings, engineering plans, or some other form of detailed blueprint, be prepared for a thorough review on behalf of your local authority to make sure your project complies with the rules.

Whatever project you have in mind—whether converting existing structures or building new ones—it’s important to become well-versed in the permits and regulations that will allow you to get it approved hassle-free. Consult with local authorities to get the full picture of what’s required from you. Once you’ve checked all the boxes, you’ll be well on your way to maximizing the value of your property.

Curious what your return on investment might be when it’s time to sell? Contact me for a Comparative Market Analysis. I can also put you in touch with a property management company to estimate market rental rates in your area.

Adapted from an article that originally appeared on the Windermere blog September 6, 2023.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

7 Common Scams to Avoid

Whether through email, text, malicious websites, or phone, scammers are constantly trying to separate you from your money. Tactics range from a simple fake website to elaborate schemes in which people assume a false identity and convince you to wire them thousands of dollars; they may even come back for Round 2 and scam you a second time by pretending to help you recover your lost funds. Big red flags are pressure to act quickly and requests for money in the form of a wire transfer, gift card, cryptocurrency, or other untraceable payment. You should also pause if any person or company—even one you know and trust—is asking you for personally identifiable information (your bank or employer will never email you to ask you to verify your username, password, or PIN).

In real estate, we are constantly striving to protect our clients from fraudsters. We consulted both our experience and the FBI’s fraud department to bring you this list of common scams and how to avoid them…

1. Rental Scams

HOW THEY WORK:

Scammers offer a bogus rental opportunity and pressure potential renters into sending personal information and/or money for fees, deposits, or rent.

HOW TO PROTECT YOURSELF:

- Beware of “too good to be true” rental offerings, particularly those with a sense of urgency and anyone not willing or able to meet in person.

- Confirm that the property is actually for rent by cross-checking on multiple websites and confirming the contact info matches—don’t trust links sent to you by email or text.

- Don’t give away personal information before the touring the property or in response to unexpected requests.

- Tour the property in person, or have your agent or a trusted friend/family member tour it for you if you’re out of area. Note: some scammers will actually meet you at the property and may even have a code to get into the lock-box, which leads us to…

- Vet the person offering the rental. If they’re emailing you, check the domain name after the @ carefully (if it’s something generic like @gmail, be extra cautious since those can be created by anyone). If it’s a service, check their reviews on the Better Business Bureau and other review sites. You can also ask for a business card; if they’re an agent, ask for their license number and check it against the state database (here is Washington’s). If you’re working with someone claiming to be the owner, check county records to ensure their name matches the owner on record.

- Never pay any fees, deposits or rent via wire transfer, cryptocurrency, gift cards, or a sketchy website you don’t recognize. Use traceable methods like an ACH transfer through your bank, or a debit/credit card…after you’ve vetted the person and the listing.

2. Business & Investment Fraud

HOW IT WORKS:

- Advance fee schemes convince victims to invest money up front for a future, larger return that never comes.

- “Nigerian Prince” letter schemes promise you a cut of some huge sum of money in exchange for helping someone illegally transfer it out of their home country.

- Ponzi schemes collect money for a bogus investment, and then use incoming money from new investors to pay previous investors until the whole thing collapses.

- Pyramid schemes operate like a hierarchy where you send money to people above you and are promised huge returns by bringing in new investors below you. People at the bottom lose…and the whole setup is illegal.

- Telemarketing fraud schemes coerce money from you over the phone by claiming you won a prize, convincing you you’re in legal trouble, and any number of other imaginative claims.

- Cryptocurrency investment fraud involves scammers manipulating victims into depositing fake “investments” via cryptocurrency; in the end, they lose all of the money they invested to the criminals.

HOW TO PROTECT YOURSELF:

- If it sounds too good to be true, it probably is. There is no such thing as a guaranteed return, and you should be wary of anyone promising you’ll get rich quick.

- Never rush into an investment opportunity. Pressure to invest now and “get in the ground floor” is a red flag that you’re probably being scammed, especially if they ask you not to tell anyone about it.

- Never invest on the advice of someone you meet solely online. This includes strangers and people claiming to be long-lost contacts on social media.

- If you believe you’ve been victimized, don’t pay additional fees/taxes to access your money. This is part of the scam, as well as any service that claims it can help you recover your lost funds.

3. Home Purchase Wire Fraud

HOW IT WORKS:

You receive a message that looks like it’s from a trusted sender, giving you instructions on wiring money for making a payment during the home buying process. The money goes straight into the fraudsters’ account.

HOW TO PROTECT YOURSELF:

- Pre-plan the closing process, discussing payment options with your lender. Call them directly and ask specifically about instructions for wiring funds (don’t ask for this over email since scammers usually operate by compromising the email address of one the parties).

- Record contact information for trusted people involved in your purchase process, including your agent, lender, title company, and attorney. If someone new reaches out, confirm their identity by speaking directly with one of your trusted contacts.

- Call a known number to confirm wiring instructions before sending any transaction through. Talk to one of your trusted contacts and ask them to repeat the wiring information to confirm it’s legit. Call again after the transfer to ensure that funds were received.

- Watch for red flags like someone saying that you previously sent funds incorrectly, that they were never received, that there are new instructions for payment, or that there has been a last-minute change to the closing process. Call a trusted contact immediately.

- Read our full article on wire fraud.

4. Timeshare Fraud

HOW IT WORKS:

Fraudsters claim to help timeshare owners exit, rent, or invest their timeshares with upfront taxes or fees required (which the scammer pockets). Once the victim realizes they have been scammed, the fraudsters may re-approach them posing as lawyers, police, or government officials claiming they can help recover the lost money—again, requesting upfront fees. Some may even threaten the victim with prison time if they don’t pay up.

HOW TO PROTECT YOURSELF:

- Stop communicating with anyone who requests cash upfront for something related to your timeshare. This is true no matter which institution they appear to be with or what contracts, letters or bank account documentation they may provide (criminals do their homework and sometimes create fraudulent documents).

- Don’t send legal documents via email. Never sign, notarize, or send any power-of-attorney or other document.

- If you’ve been scammed, stop sending money, file a report with the FBI’s Internet Crime Complaint Center (IC3) and only work with them. Do not communicate with anyone who claims to be a government official reaching out about a settlement, threatening to arrest or prosecute you if money isn’t paid, or threatening to subpoena you.

5. Fraudulent Charity Scams

HOW THEY WORK:

Criminals exploit tragedies, natural disasters, or political events to seek donations for fake charities.

HOW TO PROTECT YOURSELF:

- Give to trusted charities/groups by manually typing out the web address. Don’t click on links or open attachments to donate. Look out for organizations with copycat names trying to impersonate reputable organizations.

- Vet charities before you give by using a site like the BBB Wise Giving Alliance, Charity Watch, or Charity Navigator. You can also search the charity’s name plus “complaint,” or “scam.”

- Give using a check or credit card. Avoid any request to donate via cash, gift card, virtual currency, or wire transfer—it’s probably a scam.

6. Elder Fraud Schemes

HOW IT WORKS:

- Romance scams involve scammers who use the illusion of a relationship to manipulate and steal from the victim.

- Tech support scams allow criminals to gain access to victims’ devices and sensitive info by posing as support reps and offering to fix non-existent computer issues.

- Grandparent scams involve criminals impersonating relatives in urgent financial need to extort money from victims.

- Home repair scammers charge homeowners in advance for home improvement services that never happen.

- Sweepstakes/lottery scams convince the victim they have won a large prize that they can collect for an upfront “fee.”

- Government impersonation scams extort money from targets by frightening them into believing they must provide funds or payments to avoid arrest or prosecution.

HOW TO PROTECT YOURSELF & YOUR FAMILY MEMBERS:

- Never send money, gift cards, or valuables to anyone you have only communicated with online or by phone. In addition, never send sensitive financial information or inappropriate photos that could later be used to extort money from you.

- Create a shared verbal password that only you and your loved ones know.

- Be wary of unsolicited calls, mailings, and door-to-door service offers. Vet any contractors before you hire them (especially anyone requesting payment before work is performed). Be aware that legitimate tech support services will never reach out to say something is wrong with your computer.

- Resist the pressure to act quickly. Scammers use urgency and fear to coerce victims into immediate action.

7. Spoofing & Phishing

HOW IT WORKS:

- Spoofing is when someone impersonates a trusted person or company by disguising their email address, name, number, or website.

- Phishing schemes typically use spoofing to get you to think you’re on a legitimate site, then obtain your password, credit card number, banking PIN, or other sensitive info by making you think you need to update or verify your personal information.

- Variations include Vishing (same thing but over phone or VM), Smishing (phishing via SMS text message) and Pharming (your computer is infiltrated with malicious code that redirects you to fake websites).

HOW TO PROTECT YOURSELF:

- Don’t trust any company reaching out to you for your username and password—they don’t do that. Even if it’s a company you know and use, avoid clicking on any links and instead call the company directly using their official phone number to confirm if the request actually came from them.

- Pay careful attention to spelling in email addresses and websites. Spoofers often use email addresses or web addresses that may be just one letter off from the genuine ones.

- Set up two-factor authentication for all of your password-protected accounts. This adds an extra layer of security that can protect you even if a phisher obtains your username and password.

You can find information on more scams and how to avoid them on the FBI’s website. When in doubt if something is legit, stop communications and call the company directly or consult a trusted advisor like your attorney, family members, or real estate agent. If you feel you’ve been the victim of the scam, contact police directly and/or report it to ic3.gov, the FBI’s Internet Crime Complaint Center (IC3). Do not engage with anyone who reaches out to you claiming they can help you recover your lost funds.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

Sources:

https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams

https://consumer.ftc.gov/features/donating-safely-and-avoiding-scams#research

https://www.windermere.com/blog/what-is-wire-fraud-and-how-to-avoid-it

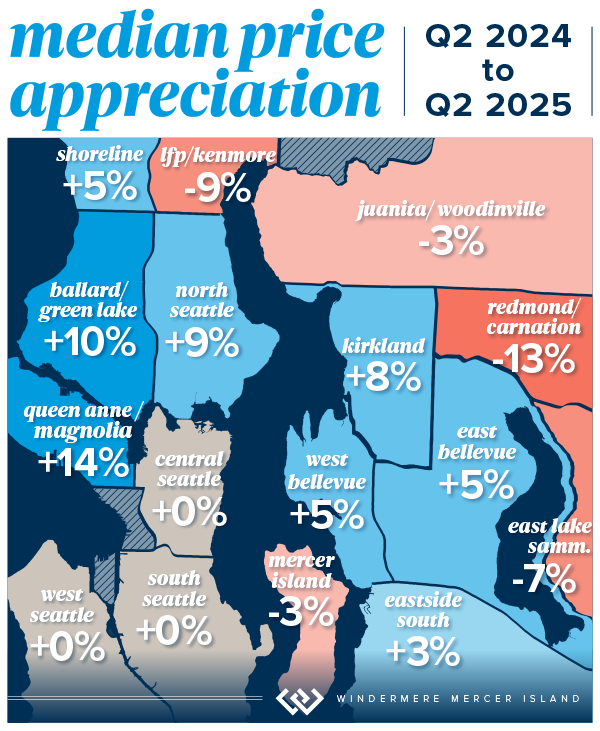

How’s the Market? Q2 2025 Review of Seattle Area Real Estate

The end of our spring market quieted down significantly as warm weather, graduations, and vacations distracted buyers and kicked off our typical summer slowdown. Despite this, Seattle posted modest year-over-year growth in both sales activity and median sales prices. The Eastside saw slight dips in sales prices and activity compared to last spring, but choice homes still sold quickly and most closed at or above their listed prices. Buyers found more room to negotiate, particularly on properties that needed work or otherwise didn’t generate immediate interest.

Our takeaways for Sellers: pricing strategy and early market momentum matter—homes that sell quickly are fetching the highest prices. Preparation and accurate positioning are key to success. For Buyers: There’s more inventory than last year, but the best homes are still moving fast and often over asking. Be ready to act decisively, especially in high-demand areas.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

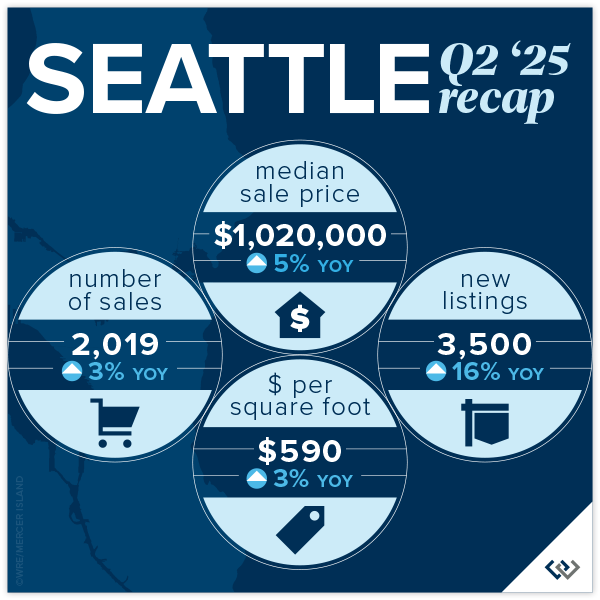

SEATTLE

Seattle was a medal winner in the Q2 relay! Median sales price in Seattle hit $1.02M, up from $968K in Q2 2024—a 5% increase year-over-year, signaling a healthy and steadily appreciating market. Despite increased inventory, sales activity rose 3% YoY with 2,019 homes sold, reflecting stable demand. Homes that sold within the first 10 days received 105% of asking price, while those on market more than 30 days averaged just 97%, so speed continues to command premium pricing.

Momentum continues to be visible across several neighborhoods. Queen Anne & Magnolia led the city with a 14% price increase, pushing the median to $1.5m—a strong signal of those wanting quiet luxury near the downtown core. Ballard–Green Lake and North Seattle also saw notable gains, up 10% and 9% respectively. Central Seattle recorded a 6% increase in price per square foot and the highest number of units sold among central neighborhoods, showing a rebound in core urban demand. Lake Forest Park was the only area with a significant decline in median price (-9%) suggesting buyer opportunity in the near-north fringe.

Much like the Eastside, inventory jumped to 3,500 new listings in Q2, a 16% increase over Q2 2024, giving buyers more choices and slightly more negotiating room, especially for homes that linger on market.

The Seattle market in Q2 2025 showed measured growth, more listing activity, and resilient demand. Whether you’re buying or selling, strategy, timing, and clarity on your market segment are what will make the difference.

Click here for the full report and neighborhood-by-neighborhood statistics!

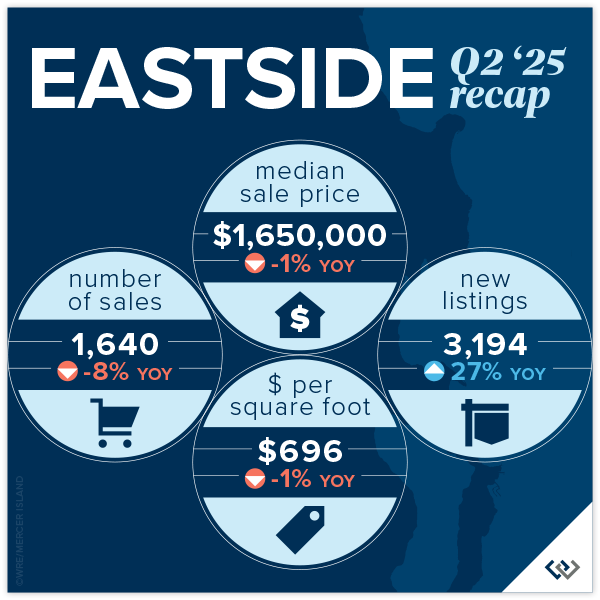

EASTSIDE

There was a listing surge this quarter and that was most significant on the Eastside! 3,194 homes were available—a substantial jump from just 2,509 in Q2 2024. This equates to a 27% increase in supply year-over-year. For buyers, there was more to choose from this quarter coupled with buyers being more selective and price sensitive. While competition is still strong, longer market times and slight price softening in some areas mean buyers have more negotiating power—especially in markets like Redmond and Sammamish.

But don’t rule out the homes priced and prepped well! Sales velocity remained strong, with 67% of homes selling at or above list price, and most (66%) selling within the first 10 days. 39% of homes even sold over asking price. The median sale price across the Eastside was $1.65M, slightly down from $1.67M last year (–1%), showing a stable but price-sensitive market. For those homes with a longer market time (over 30 days) on average, sellers took a 3% negotiation.

Areas like Sammamish (–7%) and Redmond (–13%) experienced the most significant price drops—indicating opportunities for buyers who are priced out of West Bellevue or Kirkland. If we’re talking community standouts, West Bellevue leads the pack in pricing, with a median sale price of $3.75M, up 5% year-over-year, and the highest price per square foot at $1,151. Kirkland saw the largest year-over-year price increase, up 8%, pushing the median to $2.19m. Redmond was the only major submarket to experience a notable increase in number of homes sold (+15%), despite a 13% price drop, suggesting high buyer demand for more affordable options.

Q2 2025 brought more listings and more choices, but the market remains fast-moving and price sensitive. Our takeaways for Sellers: pricing strategy and early market momentum matter—homes that sell quickly are fetching the highest prices. Preparation and accurate positioning are key to success. For Buyers: There’s more inventory than last year, but the best homes are still moving fast. If the home is listed, the seller is ready to make a deal. Whether you’re buying or selling, strategy, timing, and clarity on your market segment are what will make the difference.

Click here for the full report and neighborhood-by-neighborhood statistics!

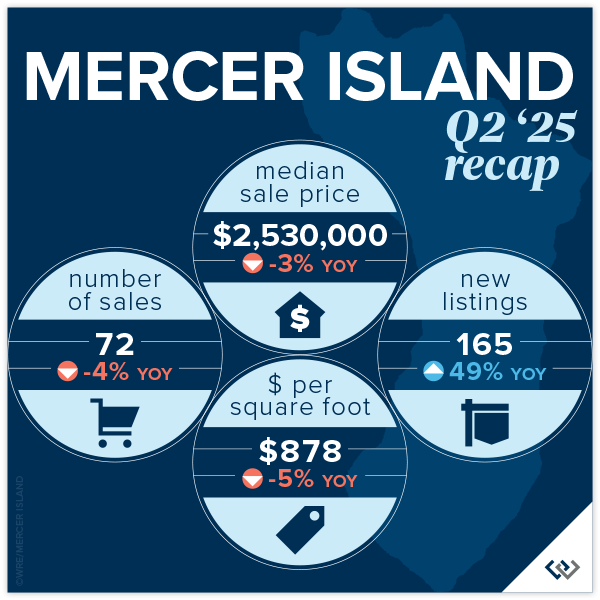

MERCER ISLAND

Mercer Island’s Q2 2025 market remains robust, especially for well-positioned single-family homes. As predicted, those homes that were prepped well and priced strategically found serious buyers quickly—many selling within the first 30 days. 64% of homes sold at or above their list price this quarter, a strong signal that sharp pricing and smart timing paid off.

What’s less visible in the headline numbers is that 38 of the homes listed in Q2 are still active today. This speaks to the importance of days on market as a key driver: homes that sold within the first 10 days (71% of sales) received 102% of asking price, while those on the market longer than 30 days fetched just 96%. A 4% negotiation window suggests buyers are discerning, and sellers may be responding to increased competition while planning for a typical summer slowdown.

With 72 residential sales, Q2 showed a healthy level of activity, but overall urgency softened, leading to downward pressure on pricing. The median sales price slipped to $2,530,000 from $2,937,000 in Q1, showing that the early-year momentum didn’t carry through Spring. Still, when compared to Q2 2024’s $2.5m, pricing has remained remarkably resilient.

Neighborhood standouts: the Westside led the market with strong price per square foot and intense buyer interest – 5 of the 6 homes sold within the first 10 days. The North End saw the highest sales volume with 14 homes sold, proving to be a consistent favorite. The South End offered 7 sales at a reasonable price per square foot of $722 vs. the North End’s $885 per foot.

While the data shows a seller-leaning market, buyer demand is unpredictable. With an uncertain Fall market ahead, sellers should prepare for longer market times, and bring patience along with their listing prep. Buyers, on the other hand, should know that opportunities exist across the island, especially in the condo sector, where activity is softer and pricing may be more approachable for those looking to establish a foothold on Mercer Island.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Condos remained an accessible entry point for buyers across our region, with Q2 marking a strong showing. In Seattle, the most robust demand was found in more affordable neighborhoods like South and North Seattle—North Seattle alone saw a 24% jump in median price. Meanwhile, the luxury condo segment in Downtown Seattle moved more slowly, with average price per square foot landing at $794.

On the Eastside, the condo market felt uneven but held its value overall. While pricing trends varied by submarket, Eastside condos continued to outperform Seattle in overall price strength. Woodinville and Redmond stood out with impressive gains, while Mercer Island saw a softer quarter with just four sales and a median price dipping to $618K.

Sales activity rose 7% on the Eastside and 5% in Seattle compared to last year. Homes that sold within the first 10 days garnered the most attention, suggesting well-priced listings are still commanding strong interest. In Seattle, 53% of condos sold at or above list price; on the Eastside, that number climbed to 58%—a clear sign that buyers are negotiating in a competitive environment and pricing remains fluid.

With the single-family market still tight, condos—particularly those priced under $700K—continue to offer buyers a compelling path to homeownership in desirable neighborhoods.

Check out area-by-area details in the full condo report.

WATERFRONT

Lake Sammamish and Eastside waterfront saw a busy Q2 with 13 and 9 sales respectively. After a big Q1, Seattle waterfront sales slowed in Q2 with just 4 sales (as opposed to 10 last quarter). Mirroring the overall market, waterfront saw some softening on price—the vast majority of homes sold at or below their list prices with just a few choice properties attracting bidding wars.

Yarrow Point garnered the largest sale price of $13 million for an immense Cape Cod inspired estate encompassing over half an acre, 7,465 sq. ft. of interior living spaces, and 82 feet of prime low- to no-bank waterfront. Lake Sammamish offered the best bargain—an original 1975 lake house on 1/3 acre with 50 feet of waterfront that was snagged for $2.6 million.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

View the full waterfront report

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Codi Nelson, by HD Estates Photography. Eastside cover photo courtesy of Fred Fox & Julie Wilson by Bobby Erdt, Clarity Northwest Photography. Mercer Island cover photo courtesy of Janet Bell & Julie Wilson, by Bobby Erdt, Clarity Northwest Photography. Condo cover photo courtesy of Luke Bartlett, by Kealin Branson, Clarity Northwest Photography. Waterfront cover photo courtesy of Nancy LaVallee, by Amaryllis Lockhart, Clarity Northwest Photography.

2025-2026 Football & Hockey Schedules, Recipes, & Tips

Football is almost here and hockey is coming in hot behind it! Scroll down for printable schedules, tailgating hacks (including how to pack the perfect cooler!), and favorite gameday recipes. Fans of all ages will also love our printable football and hockey bingo sheets.

Need to brush up on your sports lingo? Check out Wikipedia’s handy football and hockey glossaries. You can say impressive things like, “Are they running a 3-4 defense?” and “It’s not icing unless the puck passes the goal line…”

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

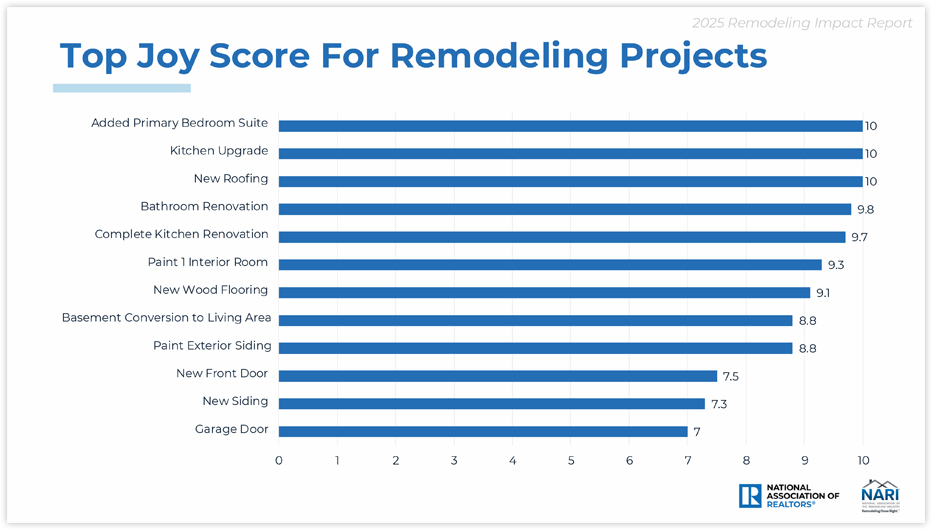

Remodeling Impact Report: Projects That Bring Joy & ROI

Is your home ready for a refresh? Whether it’s for their own enjoyment or to prep their houses for sale, Americans are investing more and more money into remodeling each year. According to a recent report by the National Association of REALTORS® (NAR), the demand for top-condition homes is going up among buyers as well. So which projects will get you the most bang for your buck? Or, perhaps more importantly, which projects will bring you the most joy? Here’s what the Remodeling Impact Report revealed…

Projects That Boost Your Happiness

It’s easy to think about improvements in terms of monetary value…but what about the value of enjoyment and enhanced livability? As part of their report, NAR calculated a “Joy Score” for common remodeling projects based on the happiness homeowners reported with their renovations. Three projects stood out with perfect joy scores: adding a primary bedroom suite, upgrading the kitchen, and replacing roofing. Here are the projects with the highest joy scores:

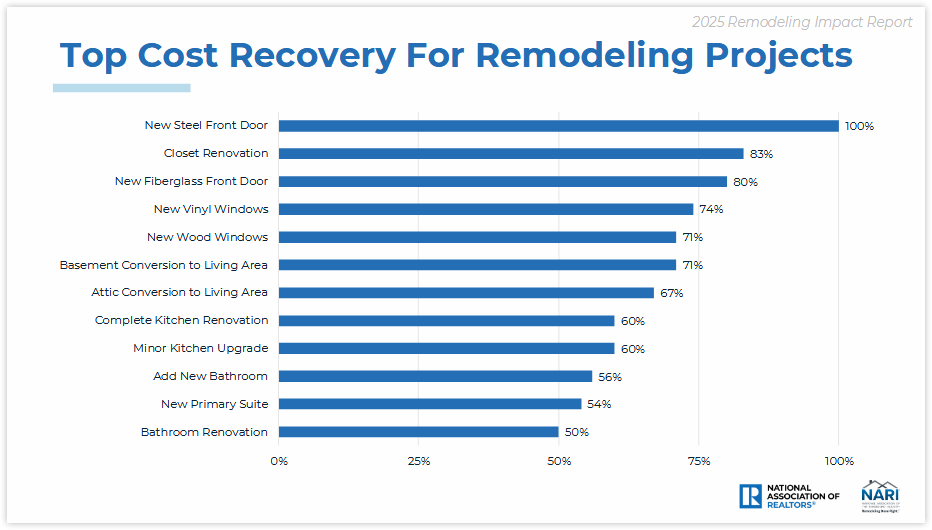

Projects That Help Pay for Themselves

As a bonus to bringing you joy, many projects will also pay you back for at least a portion of their cost when it’s time to sell your home. Projects that increase your home’s curb appeal tend to bring you the highest return on investment (ROI), although closet renovation snuck in as a surprise gem:

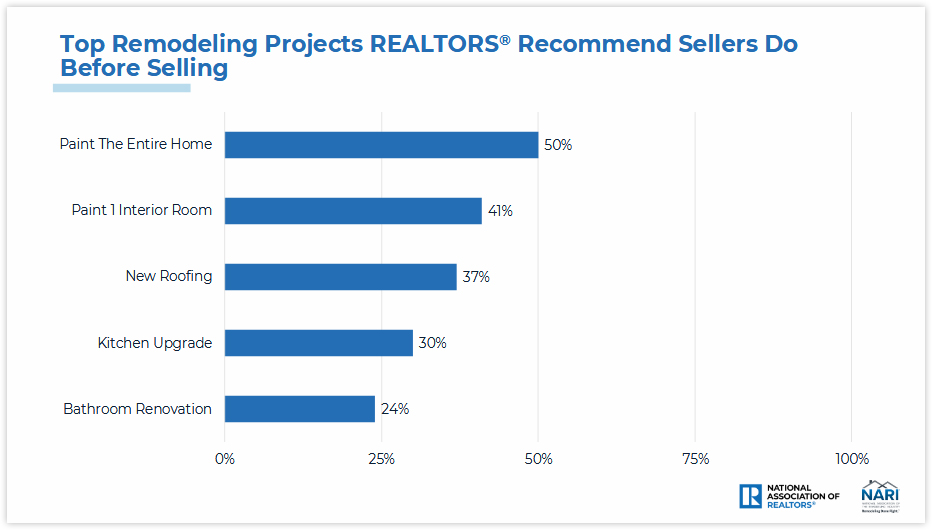

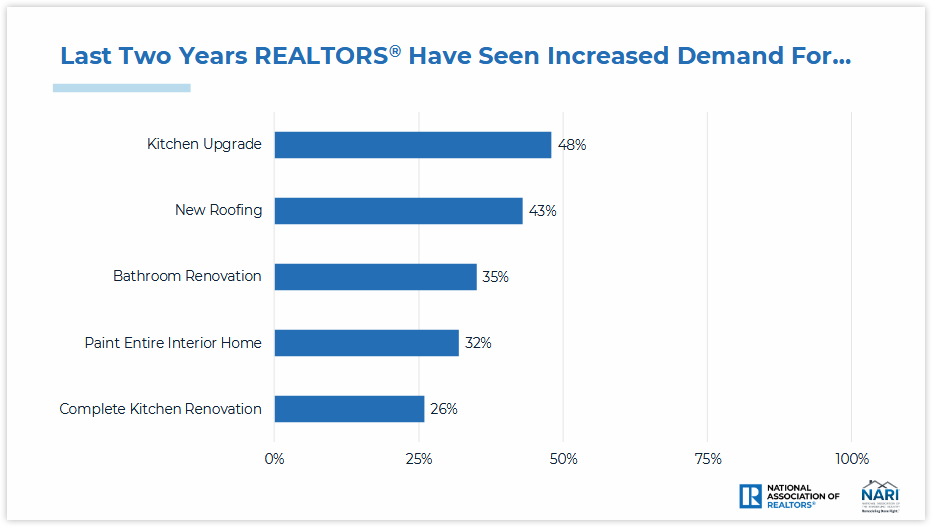

What If You’re Remodeling to Sell?

In virtually any real estate market, a home that feels fresh, clean, modern, and move-in ready will always sell faster and for more money than its dated counterpart. This isn’t always tangible in the ROI studies but, as agents, we see it every day. The good news is that the updates you make to sell are often more cosmetic and less expensive than the upgrades you might make if you were planning to stay in the home forever (pssst…check out this article on remodeling projects you should avoid if you’re selling your home).

The two charts below show both the projects REALTORS® most often recommend sellers do before selling, and five projects we’ve seen increased demand for from buyers:

It’s critical to understand that every home, neighborhood, and situation is different. Your home’s unique characteristics and your personal goals as a homeowner will have more impact on which remodeling projects are best for you than any of these general trends. If you’re remodeling to sell, reach out for advice; I’m happy to help you choose the right projects—and avoid the wrong ones—to help you accomplish your objectives.

Data & charts copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link